From moodys.com today.....

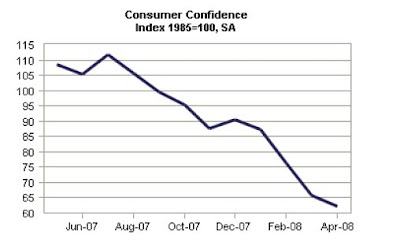

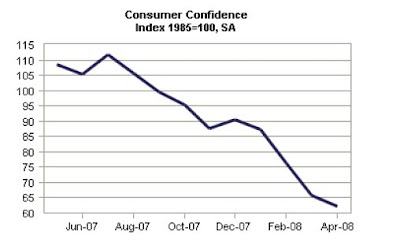

http://moodys.comThe Conference Board index of consumer confidence dipped modestly again in April, in line with expectations. The index came in at 62.3, down from April’s upwardly revised 65.9 (previously 64.5).

This was the fourth consecutive decline in the index and left it at its second lowest level since October 1993. Assessments of labor market conditions fell again. The share of consumers finding jobs plentiful fell 2.6 percentage points to 16.6%, the lowest reading since September 2004.

Consumers are also becoming increasingly concerned about the outlook for their incomes, which does not bode well for spending.

Buying plans for homes fell further, matching their lowest level since December 1982. Debt burdens are high and saving is low, and cash flow is becoming hindered by the increased difficulty in obtaining credit and declining home equity. There also is the burden from energy prices, as oil continues to track near $120 and gasoline prices appear headed toward $4.00 per gallon.

Consumer expectations for inflation soared to the second highest level on record back to 1987.

There is a long list of drags on confidence, including soaring energy prices, weakness and volatility in equity markets, weakening housing markets and stretched household finances. On top of this, the labor market is deteriorating.

Dan Ross

http://BetterBizBooks.com