Let the debate begin.

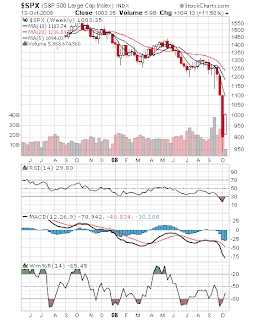

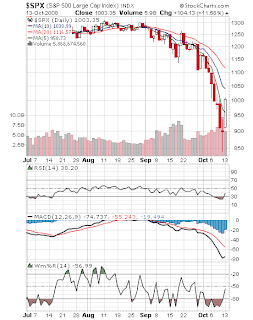

I for one, think Deflation and Inflation will be fighting for quite awhile. Deflation is here and it is getting NASTY in a hurry (oil from $140 a barrel to $60 in 4 months?) but the governments of the world have the printing presses going OVERTIME to avert such a situation. So, as the printing presses go wild to prop up the economy (and add inflationary worries) get prepared for WILD, VOLATILE markets. Get your employees and customers prepared for WILD, VOLATILE markets. If you look like you know what is going on you are 20 steps ahead of the next business. Below is a video from yahoo discussing the situation. Below are some helpful tips for businesses to succeed in this environment.

>

Six ways for small businesses to prepare for deflation:

1. Scenario Planning: This is what successful, large enterprises do LEAPS and bounds better than smaller enterprises. Typically because they have resources to dedicate SOLELY to this purpose. They develop action plans based on various changes to their industry and look for threats and opportunities based on how they see things playing out in their industry. How will input prices and market forces (like interest rates) impact their company/industry. Which companies have too much debt or are poorly hedged with commodity exposures? Which management teams have depth and can survive an exodus of talent given a volatile market? Deflation may not cut across all sectors equally since commodity prices swing more wildly than semiconductor prices. How will your company adapt?

2. Inventory Reductions: Imagine buying oil as an input for your business at $140 per barrel in July. Today it is $60 per barrel. The business that has to sell its products at $140 is either going to sell at a loss or sell for a MUCH higher price than the business that bought at $60 per barrel. The raw materials cost can destroy a business with such volatility. As such, you need to operate your business on the Just-In-Time (JIT) inventory model or learn to order smaller amounts in shorter cycles to take advantage of dropping prices and optimizing profits.

3. Avoid Commodities: Have you seen oil come down from $140 + in July to the low 60s recently? You can count corn, soybeans, natural gas, etc. in that same bucket/set of issues. Commodity based businesses will have MORE volatility in the next 12-18 months than you can shake a stick at. You need to reposition your business as a niche marketer of high value goods. You need to be selling on VALUE and not on price. How can you add value?

4. Increase Productivity: Not all deflation is negative and wealth destroying. Deflation can benefit small business by making technology affordable. In such an environment you would be well served to buy technology boosts the productivity of your company. This should enhance the bottom line and give you more flexibility with your financials.

5. Cut Costs: Understand which costs are truly adding value in your enterprise. Which costs can be upgraded at the same cost? (ie. better quality) At the same time understand what costs are "nice to have" goods and services. Are you getting maximum productivity in your employees? Is there "dead weight" and which employees truly go "the extra mile" for your customers.

6. Review Contracts: This is a HUGE concern, especially for manufacturing companies. Holding a long-term contract during a period of dropping prices locks you into a high price point. On the contrary, negotiate longer contracts with clients if at all possible to hold your margins and profits.

Dan Ross

http://www.BetterBizIdeas.com/