Wednesday, December 24, 2008

Gary Shillings (author of Deflation) prediction for 2009

Please note that he wrote a book called Deflation, in 2001. He's been crying wolf for quite awhile but his prediction eventually came true. In the attached videos, he predicts S&P 500 at 600 ($40 in EPS for the combined companies and a 15 multiple). I think he might be too pessimistic .....My bearish scenario is 650 to 700 on the S&P500.

In this follow up video he says that China's middle class isn't large enough to absorb the decline in exports and, as a result, there might be social upheaval in China. I've already seen people flipping cars near police stations in China so I don't find this to be a big surprise.

A noted and notable bear, Shilling predicts the following will occur unless drastic action is taken:

Average U.S. home prices will fall another 20% from current levels, bringing the peak-to-trough decline to 37%. If prices ultimately do fall 37%, 25 million Americans — or about 50% of all U.S. homeowners with a mortgage — will be underwater, meaning their house will be worth less than their mortgage.

Millions of Americans won't be able to make mortgage payments, even if they're able to refi at today's low rates.

Shilling also indicates that there is too much supply vs. demand of homes. As a result, he proposes giving more H-1B visas to attract more highly skilled immigrants, who can then purchase homes, to absorb some of the inventory. My question is "Do H-1B visa people, who don't really have any sense of permanence here in the U.S., purchase homes?" I think I am qualified to ask this question as I gained my U.S. citizenship in July this year (long time procrastinator). On another note, my father worked 30 years + as a Sr. Exec for a major telecom equipment companies and was a HUGE user/supporter of H-1B visas over his years when they needed people with the right skillsets.

Dan Ross

Monday, December 22, 2008

Facebook Connect ?? What is that ?? Too much info shared with others??

The issue I see with this technology is that (1) Google really drives search results so marketing probably won't benefit from this & (2) tons of your info. becomes publicly available that perhaps you didn't want your friends knowing before. I'd lean to the google solution if I was a developer trying to increase my rankings in search results :)

Dan Ross

Sunday, December 21, 2008

Truth about Lithium Ion Batteries & Autos??

Most batteries appear to be coming out of Japan/China for Lithium Ion Technology. They are ponying up the $$$ to build manufacturing TODAY and obviously R&D has occurred and will continue to occur.

Dan Ross

Saturday, December 20, 2008

Hoard Happy Friends and Dump the Grumps!

Dan Ross

Friday, December 19, 2008

Continued Mortgage Mess in 2009?

This story was broadcast on Sunday, December 14th, 2008.

Watch CBS Videos Online

Dan Ross

Thursday, December 18, 2008

Are Hedge Funds Dead?

http://seekingalpha.com/article/110563-the-hedge-fund-business-is-finished-and-bernie-madoff-is-sealing-the-deal?source=email

"I have a feeling that the hedge fund offices around the world are being inundated with phone calls from people with a need to get up and close with their money. The ramifications of this could mean we are in for that trade we all hoped would never come...........'the capitulation trade'. Would you be able to sleep at night knowing some shill in the Hamptons on a computer may be using some white out to manipulate your investment statement.

The hedge fund business is finished, and Bernie Madoff is sealing the deal. There's nothing like fraud and corruption to put the cherry on the sundae. I know techincally, Madoff didn't run a hedge fund. But is this going to help the unregulated hedge funds, when Madoff, who was regulated, can't be stopped."

My Take: We'll find out in January when the next redemption period occurs for hedge funds. That is what I have heard anyway. I still think the market heads lower in 2009 & the S&P, which is around 850 in recent weeks, heads to 700 with no problem at all.

Dan Ross

Wednesday, December 17, 2008

Water Energy / Tidal Energy Economics

Watch CBS Videos Online

Dan Ross

3 Retail Stocks to avoid

Debt kills companies, some of the concepts are worn out and the consumer ain't spending their $$$ unless you differentiate. These retailers might be in hard times per TheStreet.com. Makes sense to me....

Dan Ross

Tuesday, December 16, 2008

From an E-mail I received re: U.S. manufacturing and its importance to the U.S. Economy

Joe Smith started the day early having set his alarm clock (MADE IN JAPAN) for 6am while his coffeepot (MADE IN CHINA) was perking, he shaved with his electric razor (MADE IN HONG KONG). He put on a dress shirt (MADE IN SRI LANKA), designer jeans (MADE IN SINGAPORE) and tennis shoes (MADE IN KOREA). After cooking his breakfast in his new

electric skillet (MADE IN INDIA) he sat down with his calculator (MADE IN MEXICO) to see how much he could spend today. After setting his watch (MADE IN TAIWAN) to the radio(MADE IN INDIA) he got in his car (MADE IN GERMANY ) filled it with GAS (from Saudi Arabia) and continued his search for a good paying AMERICAN JOB. At the end of yet another discouraging and fruitless day checking his Computer (Made In Malaysia ), Joe decided to relax for a while. He put on his sandals (MADE IN BRAZIL) poured himself a glass of wine (MADE IN FRANCE ) and turned on his TV (MADE IN INDONESIA), and then wondered why he can't find a good paying job in AMERICA .

My Counterargument: We don’t manufacture ANYTHING anymore. Nowhere above does it say that the alarm clock, tea pot, griddle, etc would be 2x-3x as expensive if it was made here. Heck, Joe wouldn’t be able to afford all those things if it weren’t for global manufacturing :)

We DESIGN/ENGINEER the new technology for the computers here (higher value-add). We design the “chic look” and then sell the computers (since relationships are key) but we don’t do items like MANUFACTURE or MAINTAIN SERVICE as those are outsourced to LOW cost centers. Why? Because the customer doesn’t give a crap where the computer was made as long as the quality of the product is comparable to what they were getting before. There isn’t much “proprietary” building/technology in a computer. Most of the components are made by someone else so it becomes a game of who can sell the most units (to leverage pricing with suppliers) and produce the product at the lowest price (to squeeze out low to medium sized competitors). Is the customer willing to pay a premium for a U.S. built computer? I don’t think so…

That is EXACTLY why everything got outsourced. So we could buy all this stuff that we might not need, on credit with borrowed money, to support workers overseas:)

Now customers are STARTING to care about where their customer service comes from as Dell recently brought customer service back from India after getting so many complaints.

Dan

Personal Responsibility for Health/Behaviors?

I get personal responsibility & free will but this is one socially irresponsible business I wouldn't mind seeing going out of business. I would have ZERO problems with the IRS saying tax any food/meal combo with calories > 3000 calories (150% higher than daily allowance, let alone a meal.....) Am I getting liberal in my thoughts? YIKES!

With the economy slowing down are FAST food sales going up and thereby contributing to long-term health problems? People are looking for CHEAP food but the problem is that most of the cheap options are high in fat and very unhealthy. So are you taking on short-term cost savings that might be hurting your long-term health of your wallet? Something to chew on :)

Dan Ross

Recycling in 2008/2009 getting MUCH tougher

Dec 7th, 2008 post

http://biz.yahoo.com/ap/081207/recycling_bust.html

Great article that really highlights some of that industry's dynamics.

1) They re-sell the materials to steel producers and paper producers, etc.

2) We have a global glut of raw materials and not enough demand

So who buys the raw materials from re-cyclers when there is already enough raw materials that can be bought cheaply?

"Cardboard that sold for about $135 a ton in September is now going for $35 a ton. Plastic bottles have fallen from 25 cents to 2 cents a pound. Aluminum cans dropped nearly half to about 40 cents a pound, and scrap metal tumbled from $525 a gross ton to about $100."

"Last year, Americans generated about 254 million tons of trash, according to the U.S. Environmental Protection Agency. They recycled about 150 million tons of material -- roughly 80 million of that in iron and steel -- supporting an industry that employs about 85,000 with $70 billion in sales, said Bob Garino, director of commodities at the Institute of Scrap Recycling Industries Inc., a Washington, D.C.-based trade association that represents more than 1,600 companies worldwide.

Most recyclables are shipped to Asian countries that use the material to make products that are shipped backed to the United States to be sold."

Dan Ross

Economic Slump is hitting China workers now

Dan Ross

Monday, December 15, 2008

The U.S. Dollar has biggest One Week Decline in 25 years - Did you know that?

"The U.S. Dollar ....its largest one week drop in percentage terms in at least 25 years."

"Historically, a falling dollar has generally not been positive for stocks. It will, however, provide some support for exporters and enhance demand for commodities that are quoted in dollars across the globe."

"Now with the mushrooming U.S. debt on top of an already severe economic crisis, the prospects for the U.S. economy relative to that of some of other global economies is being reevaluated from one of the strongest to perhaps only slightly better than average.

The dollar appreciated approximately 23% from July to November. This week the dollar moved below its 50 day moving average for the first time since the July bullish move again. "

My take: I've been commenting on this blog that we, as a country, can't print our way out of this problem without inflationary concerns creeping back into the economy. I didn't expect the U.S. dollar to begin collapsing this quickly. Then again, this is only a pullback, not a collapse :) But it does get me worried how quickly the dollar has fallen. I look for commodity prices to begin rebounding as most are denominated in U.S. dollars. Oil should start to creep back into the $50 price per barrel area and maybe even hit $60 if the trend continues. I expect cuts from OPEC to actually start happening at some point although, from what I have read, so far only 800k of the 2 million barrel cuts have actually started to happen. Countries continue to overproduce to pay for their committed government spending this year.....and likely next :) As a result, I think that market volatility for commodities and equity prices will be around for awhile :)

Oh, by the way, you see the 60 minutes show that had the head of Saudi Arabia's oil industry talking about the price of oil? Saudi Arabia is INCREASING their production capacity, giving them more control over the oil industry and volatility of prices (in theory.) Production will go from 10 million barrels per day to 12 million barrels per day once the project is done. By early 2009 their capacity will be up and oil prices will remain down. Talk about taking hybrid autos on. With oil in the sub 50s do hybrids ever get market acceptance? Will consumers, in an economic downturn, pay the premium price for a hybrid vs. a gas guzzling SUV? I think we are ADDICTED to oil and these guys are going to enable us to be that way for quite awhile. O, by the way, the Saudis publicly say that they would like oil to be at around $75 per barrel and their break-even price is $55 (where the country actually spends more $$$ than they make from oil sales, 75% of their economy.)

Watch CBS Videos Online

Here is Part 2 of that interview.

Watch CBS Videos Online

Dan Ross

Great Follow Up Interview on Commercial Real Estate

Dan Ross

Sunday, December 14, 2008

Merrill Lynch's Outlook for 2009 (Pessimistic)

This recession IS different and there are only two comparable declines to measure against (japan in the 90s and the U.S. in the 30s).

11 months of new house supply vs. 9 months in the early 90s (big recession). As a result, he sees another 15% decline in housing in 2009.

Consumer staple stocks is the way to go, in their opinion, for those that like big cap stocks with dividends. I think that is sound but tobacco, while not socially responsible, pays HIGH dividends and seems to be HIGHLY recommended by them.

I'll update later today/tomorrow in the comment section with some other thoughts from Merrill Lynch....

Another thought....I wonder if he still has a job after the research layoffs as Bank of America merges research with Merrill Lynch. I think he has been VERY right the year!

Dan Ross

Friday, December 12, 2008

Thursday, December 11, 2008

A few CEOs and their thoughts on the recession

http://finance.yahoo.com/career-work/article/106252/The-Recession:-What-Top-CEOs-Are-Thinking

A few comments that really rang a bell with me.

1) Robert Nardelli, CEO of Chrysler, said he could see unemployment at 10% +. Based on his record as a CEO I don't really know how valuable his information/thoughts are. The guy had a VERY unsuccessful tenure at Home Depot after leaving GE and now ran into one of the worst economic climates in modern day history. Chrysler is toast in my opinion, whether or not they get some bailout or not.....

2) Lewis Hay, FPL Group (utility business) said " Probably 25% of our customers are past due. Normally, it's more like 15%. Another issue is access to capital. We had plans to invest more than $7 billion this year, and we've already cut back to about $5 billion. With such a shortage of access to capital, how are we going to get all these alternative energy projects going?" <--bold for emphasis as it is rather intriguing....I think pure play businesses have a chance at getting financing more than diversified companies. It depends on whether it is debt or equity financing though. Debt financing would be more likely with diversified energy companies since there would be more collateral and equity investments would be more likely with "pure play" alternative energy companies because they would provide more upside in the long-term (higher risk/reward).

3) When asked "How long or severe do you think the recession will be?" most said mid 2010 and one CEO commented that, "The key is inflation. If inflation stays under control and confidence returns, we'll come back early. If inflation starts to roar in mid-2009 and thereafter, we have a problem. It might start to look like the mid-1970s."

I think that is one smart CEO re: concern about inflation. While we are experiencing deflation right now there is increasingly a higher probability that the U.S. dollar will fall vs. other currencies and spike inflation since the U.S. government is printing ALOT of them. If this happens we see higher commodity prices again.

Dan Ross

Wednesday, December 10, 2008

A Tale of Two Layoffs.....Auto workers vs. non Auto Workers

Interesting thoughts. Frankly, the auto companies policies are more socialistic/European in nature but the rest of the country isn't that way and doesn't want to bail out U.S. auto companies so they can continue to offer such benefits to their workers since most don't get comparable treatment themselves.

Dan Ross

http://www.BetterBizBooks.com

Tuesday, December 9, 2008

Goldman Sachs to Bid on Sanyo?

http://www.reuters.com/article/innovationNews/idUSTRE4B288M20081204?feedType=RSS&feedName=innovationNews

Dan Ross

Monday, December 8, 2008

Roubini says Auto Debt/Equity holders to get wiped out...

He is basically saying the auto guys (shareholders/debtholders) are toast. I'd back his position because I agree with it.

There is simply significantly too much capacity and not enough demand. The auto companies would burn through $35 billion in NO TIME at all given the 35% Y-Y decline in auto sales. They need to shut down factories, DRASTICALLY reduce costs and eliminate brands/models that simply don't sell enough units to generate profits.

"Loss Leaders" for one model is one thing but an ENTIRE brand is another. I don't understand what most U.S. auto companies brands actually stand for in the first place! Chevy is value, Cadillac is supposed to be luxury (VERY expensive domestic luxury auto company).....what does Chrysler, buick, dodge, GMC (professional built?), Lincoln and Mercury Mean?

This is another reason for my "eternal pessimism" re: the markets of late....

Dan Ross

http://www.BetterBizBooks.com

Sunday, December 7, 2008

Severe Market Recession in 2009?

Folks, this guy has been right EVERY step of the way. He screamed "WOLF" 2 years ago and has been right all the way down.

I agree with Roubini re: too much global supply. Demand will fall, which should cause deflationary risks. That is how oil goes from $140 to $44 in 6 months :) Having said that, I think, at some point, that certain commodities will become INFLATIONARY again as supplies get cut off and the U.S. dollar falls. Oil is the most likely to experience a notable REBOUND. It might take until 2010 or 2011 for oil prices to increase at hockey stick prices again (back to $100 +) because all of the oil producing countries need the revenue to finance projects through 2010 at a minimum. Most countries won't cut their spending quick enough so they will need to continue pumping oil at low prices to finance their spending deficits.

Given Middle East deficits, who buys U.S. assets? The asian economies is the answer....which is why I think U.S. stock prices continue to languish for awhile.

"Worst recession in 50 years" per the video below.

Dan Ross

Saturday, December 6, 2008

Chrysler hired Bankruptcy Firm.....Interesting...

If the auto companies file bankruptcy banks face up to $300 BILLION in write-downs on their balance sheets. Essentially, auto industry woes then pour back into the banking system, causing their balance sheets to erode further and re-endangering some banks. Does this completely diminish the benefit of the TARP program?

Everything I see and hope seems to indicate that there is political will t0 protect GM and Ford but I don't see any desire to bail out private equity funds that made a bad investment in Chrysler......

Dan Ross

Internet 3.0 and Google's "Open Social" Platform

Charlene Li, author of Groundswell, discusses the impact of Google's "Open Social" platform and its potential impact/competition with Facebook. It looks like we have another 2-3 years before integration and all the benefits of this platform really are seen to the average person.

She also discusses how to make $$$ in Web 2.0

Dan Ross

Friday, December 5, 2008

Dow Jones bottom in? Cramer seems to think so....

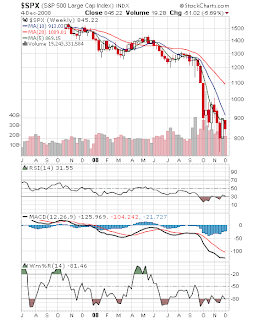

I have to disagree with him though re: this downturn being done. Until I see the S&P 500 not get pummelled by the pending convergence of the moving averages in the weekly charts (bottom chart) I won't buy into it. We should have a pretty good idea re: support for the S&P 500 by the end of December when the 10 day moving average and the price levels get close to each other.

The daily charts seem to indicate that support is being formed and that we are establishing a base of support. I would tend to agree with Cramer re: market redemptions potentially being at a peak now but I am NOT sold re: future profit taking occurring. I think people are investing ALOT less in the market today and have re-adjusted their allocations into equities. I don't think the upside is there anymore and I think A TON of leverage has been removed by the investment banks / banks that should limit the upside in the short-term. Just my 2 cents.

http://link.brightcove.com/services/link/bcpid1243645856/bctid3908038001

I could see the market going lower as unemployment soars, spending STOPS altogether and consumers TRY to re-build their balance sheets.

Here is recent news that I've read:

Today alone 20k job layoffs were announced. AT&T was 12k of the 20k alone.

http://biz.yahoo.com/ap/081205/financial_meltdown.html

http://news.yahoo.com/s/nm/20081201/bs_nm/us_finance_research_oppenheimer

http://www.cfo.com/article.cfm/12668072/4/c_12671474?f=MagazineMonthly120108

Auto sales are off 30% + in November.....I don't see these numbers improving ANYTIME soon....If the government approves a bailout the U.S. auto companies will CHEW through that $25 to $34 billion so fast you will be STUNNED. With sales off 30% + they need to go into Chapter 11 and re-structure FAST. Cut factories, cut lines of cars that aren't selling, layoff workers, re-negotiate contracts, etc. Did you know that there is more health care costs in a GM car than steel costs? True fact I recall from my days as a research analyst....

http://news.yahoo.com/s/ap/20081202/ap_on_bi_ge/auto_sales;_ylt=AmmzGDW65LZvc0aLKh.yF_OyBhIF

Abercrombie and Fitch's announced today that comp. store sales were down 28% year-over-year (Y-Y). Kohls was off 17%, JCPenney off 10%, Macys off 10%, etc. It is a bloodbath out there right now in retail land. Only DEEP discounts are getting customers to the counter. Profits will be HORENDOUS this year and I expect malls to start seeing vacancy rates RISE big time early next year as some retailers close down unprofitable locations or go belly up altogether. Oh, and I hate saying this but I expect alot of retail layoffs in early 2009. Retailers will get through the Christmas selling season and then trim, trim, trim.....

The ONLY company that was up in retail sales year-over-year was WALMART (up 8% from what I recall) as buyers looked for deep discounts at the stores. Heck, Target and Costco, who compete against Walmart and Sams Club, were both off nearly 10% in their comp. store sales.

http://news.yahoo.com/s/ap/20081204/ap_on_bi_ge/retail_sales;_ylt=Aju4RfuKxJlz0bDSrQpMHgCs0NUE

Interesting view of Aeropostale in the video below. Abercrombie and Fitch isn't discounting this season and their comp. store sales were off 28% Y-Y!

Enough depressing news for now....

Dan Ross

http://www.betterbizbooks.com/

Monday, December 1, 2008

Great Advice for Small Businesses

2) Create Evangelists

3) Know your numbers

Dan Ross

http://www.betterbizbooks.com/