This came out late last week and is worth noting....VERY important...

The Federal Reserve has so debased the dollar and pandered to Wall Street's calls for lower interest rates that foreign investors have finally begun to shun U.S. government debt. The Financial Times reports a South Korean pension fund -- the fifth largest in the world -- will stop buying Treasuries.

Money managers from pension funds to central banks must seek out higher yielding assets. The shift in foreign ownership will not happen overnight. But as long as the Fed and Department of the Treasury continue to support policies that weaken the dollar, the trend will gain steam

The fund holds only $14 billion in Treasuries, but increasing demand for withdrawals are forcing it to seek better returns.

If central banks rotate investments from Treasuries to other sovereign debt, rates will rise in the Treasury market, as sellers offer higher yields to attract potential buyers. The dollar will strengthen and asset prices will fall across the board. Higher interest rates will impede already stagnant economic growth. Asian nations hold more than half the total foreign-owned U.S. government debt. Add in OPEC and other developing countries and that number jumps to almost 70%.

Dan Ross

http://BetterBizBooks.com

Source: http://www.financialtimes.com/

Source: http://www.myanville.com/

.

Monday, March 31, 2008

Sunday, March 30, 2008

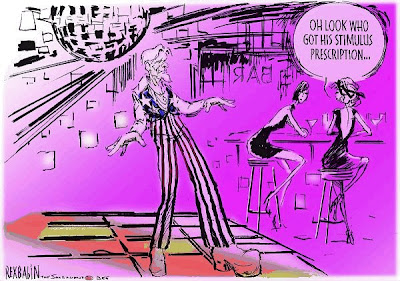

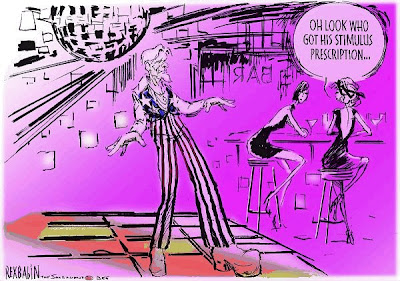

Hilarious Cartoon re: Uncle Sam and Stimulus Package

I was laughing my head off when I received this from a friend the other day.

Dan Ross

http://BetterBizBooks.com

Dan Ross

http://BetterBizBooks.com

Saturday, March 29, 2008

Even Red Hot China is starting to Slow Down/fall....

As my posts in the recent months have been U.S. economy focused I thought I would share some insights into what is regarded as the fastest growing economy in the world. The Chinese economy is forecast to be larger than Japan and the U.S. economy by 2015 :)

Chinese stocks had been trending upward at an ever accelerating rate (i.e. parabolic) since 2005. The parabolic nature of the Chinese rally came to an end as the US housing market/credit crisis began to take hold in Q4 2007. Currently, the iShares FTSE/Xinhua China 25 Index (FXI) trades within the confines of a significant downtrend.

I would also note that the Chinese government was trying to put curbs into their banking system and trying to have banks build up their capital base via loaning out all their $$$ during this time frame as well. With so much of their economy tied to their economic development (ie. real estate in China) the government had a good amount to be concerned about. The SMOG is INSANE. Having personally been to China some 15 years ago I'll attest that I was AMAZED to see entire DOWNTOWN projects (10-15 skyscrapers) going up at one time while several MAJOR 10-12 lane highways were being constructed as well.

Great charts - sign up today @ http://www.chartoftheday.com/

Source - http://www.chartoftheday.com/

Source - iShares

Dan Ross

http://www.BetterBizBooks.com

Chinese stocks had been trending upward at an ever accelerating rate (i.e. parabolic) since 2005. The parabolic nature of the Chinese rally came to an end as the US housing market/credit crisis began to take hold in Q4 2007. Currently, the iShares FTSE/Xinhua China 25 Index (FXI) trades within the confines of a significant downtrend.

I would also note that the Chinese government was trying to put curbs into their banking system and trying to have banks build up their capital base via loaning out all their $$$ during this time frame as well. With so much of their economy tied to their economic development (ie. real estate in China) the government had a good amount to be concerned about. The SMOG is INSANE. Having personally been to China some 15 years ago I'll attest that I was AMAZED to see entire DOWNTOWN projects (10-15 skyscrapers) going up at one time while several MAJOR 10-12 lane highways were being constructed as well.

Great charts - sign up today @ http://www.chartoftheday.com/

Source - http://www.chartoftheday.com/

Source - iShares

Dan Ross

http://www.BetterBizBooks.com

Wednesday, March 26, 2008

Housing Prices Holding Up? in DFW YES! Here's why...

http://news.yahoo.com/s/ap/20080327/ap_on_re_us/census_growing_cities;_ylt=AjPr7Kfz0vL2UnrxU.yZbvxH2ocA

This is why Dallas housing is holding up so well. POPULATION GROWTH IS PHENOMENAL, which drives the need for housing. It helps to absorb all the homes that are hitting the market due to the subprime mess.

Dan Ross

http://BetterBizBooks.com

This is why Dallas housing is holding up so well. POPULATION GROWTH IS PHENOMENAL, which drives the need for housing. It helps to absorb all the homes that are hitting the market due to the subprime mess.

Dan Ross

http://BetterBizBooks.com

Tuesday, March 18, 2008

4 year uptrends busted in the NASDAQ

Great chart showing the trends. With the Nasdaq at 2177 you can see how we have clearly breached the support levels and further downside is likely over the coming year.

Great charts - sign up today @ http://www.chartoftheday.com/

Dan Ross

http://www.BetterBizBooks.com

Great charts - sign up today @ http://www.chartoftheday.com/

Dan Ross

http://www.BetterBizBooks.com

Labels:

Dan Ross,

http://www.BetterBizIdeas.com,

Investing,

Nasdaq,

Stock Market

Dow Jones Stock Trends....

Another Chart from the same great service. Free so subscribe today!

http://www.chartoftheday.com/

http://www.chartoftheday.com/

As you can see, technical analysis is showing the resistance areas as well as support areas for the DOw JONES based on historic buying/selling patterns.

Dan Ross

Gold Prices since 2001

This is a great, free website I subscribe to. I have subscribed going back all the way to 2001.

Gold Prices are typically a hedge against inflation and, with a growing world-wide economy the sheer demand for commodities has been growing substantially over the last 10 years, leading to higher commodity prices. Now, people want hard assets vs. currencies, stocks, etc.

http://www.chartoftheday.com/20080314.htm?T

Dan Ross

http://www.BetterBizBooks.com

Gold Prices are typically a hedge against inflation and, with a growing world-wide economy the sheer demand for commodities has been growing substantially over the last 10 years, leading to higher commodity prices. Now, people want hard assets vs. currencies, stocks, etc.

http://www.chartoftheday.com/20080314.htm?T

Dan Ross

http://www.BetterBizBooks.com

Monday, March 17, 2008

My reviews/Lists on Amazon.com

I had prioritized this back in 2001/2002 as a big goal for me and I did a great job of it, until moving back to Dallas and beginning work at Countrywide. From there I really dove into my work and worked some hours that most people would find ridiculous ( but it was a great growth opportunity/experience.)

Anyway, I thought I would provide a link. Some of the older reviews are better (especially as it pertains to books) and I hope to get many books reviewed during the rest of 2008.

Reviews

http://www.amazon.com/gp/cdp/member-reviews/A1A7VS5J7OR71D/ref=pd_ys_homenav_rev?ie=UTF8&sort%5Fby=MostRecentReview&pf_rd_p=258341001&pf_rd_s=right-1&pf_rd_t=1501&pf_rd_i=home&pf_rd_m=ATVPDKIKX0DER&pf_rd_r=0VKQ8152N4Z3WSFP1Q6W

Listmania

http://www.amazon.com/gp/richpub/listmania/delete/247PL9RY1LU1S/ref=cm_lm_fullview_delete?ie=UTF8&lm%5Fbb=

Dan

http://www.BetterBizBooks.com

Anyway, I thought I would provide a link. Some of the older reviews are better (especially as it pertains to books) and I hope to get many books reviewed during the rest of 2008.

Reviews

http://www.amazon.com/gp/cdp/member-reviews/A1A7VS5J7OR71D/ref=pd_ys_homenav_rev?ie=UTF8&sort%5Fby=MostRecentReview&pf_rd_p=258341001&pf_rd_s=right-1&pf_rd_t=1501&pf_rd_i=home&pf_rd_m=ATVPDKIKX0DER&pf_rd_r=0VKQ8152N4Z3WSFP1Q6W

Listmania

http://www.amazon.com/gp/richpub/listmania/delete/247PL9RY1LU1S/ref=cm_lm_fullview_delete?ie=UTF8&lm%5Fbb=

Dan

http://www.BetterBizBooks.com

Bear Stearns gone for $2 per share + backing of U.S. Gov't for Chase....

Wow....

Talk about unravelling quickly....World markets crash despite the Fed cutting an additional 25 bps.

Bear Stearns had more exposure than anyone else related to mortgage industry amongst investment banks according to industry insiders so now the leading MBS, investment bank has gone under, a major Private Equity company has been stung (Carlyle Group), there have been approximately $200 billion in write-downs & everyone is yanking credit left and right. \

This is a recipe for stagflation like no tomorrow.

For those that don't know what that is, stagflation "is a macroeconomics term used to describe a period of inflation combined with stagnation (that is, slow economic growth and rising unemployment, possibly including recession).[1] "

http://en.wikipedia.org/wiki/Stagflation

http://economics.about.com/od/useconomichistory/a/stagflation.htm

Dan Ross

BetterBizBooks.com

Talk about unravelling quickly....World markets crash despite the Fed cutting an additional 25 bps.

Bear Stearns had more exposure than anyone else related to mortgage industry amongst investment banks according to industry insiders so now the leading MBS, investment bank has gone under, a major Private Equity company has been stung (Carlyle Group), there have been approximately $200 billion in write-downs & everyone is yanking credit left and right. \

This is a recipe for stagflation like no tomorrow.

For those that don't know what that is, stagflation "is a macroeconomics term used to describe a period of inflation combined with stagnation (that is, slow economic growth and rising unemployment, possibly including recession).[1] "

http://en.wikipedia.org/wiki/Stagflation

http://economics.about.com/od/useconomichistory/a/stagflation.htm

Dan Ross

BetterBizBooks.com

Sunday, March 16, 2008

Bear Stearns / Carlyle Capital - Another View....

Copy/paste from Businessweek.com and bbc.co.uk. Great work and thought provoking. I was hoping not to bastardize it so I pasted a bit more than I would like....Great article I read on Friday

http://www.businessweek.com/bwdaily/dnflash/content/mar2008/db20080313_916714.htm?chan=top+news_top+news+index_businessweek+exclusives

How could the Fed unintentionally have contributed to Carlyle's unraveling? The theory is that the Fed's action made Carlyle Capital's assets more lucrative to the firm's large creditors. Therefore, those creditors had an incentive to let Carlyle Capital fail and seize its assets. Robert Peston, business editor of the BBC, advanced the idea Mar. 13 on his blog, and the notion was quickly picked up and circulated by other bloggers.

More worrying is the explanation for why lenders are seizing the assets, which are US government agency AAA-rated residential mortgage-backed securities (RMBS). Carlyle says: “negotiations deteriorated late on March 12 when, among other things, the pricing service utilized by certain lenders reported a drop in the value of RMBS collateral that is expected to result in additional margin calls”.

That statement will reverberate through global markets today.

Why?

Well, the point of Tuesday’s dramatic $200bn intervention by the Federal Reserve in mortgage-backed markets was to stabilise the price of US government agency AAA-rated residential mortgage-backed securities and – by implication – to encourage the big banks NOT to seize assets in the way they’ve been doing at Carlyle. In fact, it’s arguable that the banks’ seizure of Carlyle’s $20bn-odd in assets has actually been encouraged by the Fed's mortgages-for-Treasuries offer. Because the Fed’s new lending emergency lending facility allows the banks to swap mortgage-backed debt for Treasury Bills in a way that Carlyle could not do. <--Remember, you have to be a primary dealer.....Hedge funds aren't :)

If that’s the case, there will be some very scared people in hedge-fund land today. Hedge funds that have borrowed from banks against the security of mortgage-backed debt could be about to see their assets sucked into the banking system and their businesses vanish.

It’s a process known as de-leveraging the global financial economy, yet another manifestation of the puncturing of the debt bubble.

Dan Ross

http://www.BetterBizIdeas.com

http://www.businessweek.com/bwdaily/dnflash/content/mar2008/db20080313_916714.htm?chan=top+news_top+news+index_businessweek+exclusives

How could the Fed unintentionally have contributed to Carlyle's unraveling? The theory is that the Fed's action made Carlyle Capital's assets more lucrative to the firm's large creditors. Therefore, those creditors had an incentive to let Carlyle Capital fail and seize its assets. Robert Peston, business editor of the BBC, advanced the idea Mar. 13 on his blog, and the notion was quickly picked up and circulated by other bloggers.

More worrying is the explanation for why lenders are seizing the assets, which are US government agency AAA-rated residential mortgage-backed securities (RMBS). Carlyle says: “negotiations deteriorated late on March 12 when, among other things, the pricing service utilized by certain lenders reported a drop in the value of RMBS collateral that is expected to result in additional margin calls”.

That statement will reverberate through global markets today.

Why?

Well, the point of Tuesday’s dramatic $200bn intervention by the Federal Reserve in mortgage-backed markets was to stabilise the price of US government agency AAA-rated residential mortgage-backed securities and – by implication – to encourage the big banks NOT to seize assets in the way they’ve been doing at Carlyle. In fact, it’s arguable that the banks’ seizure of Carlyle’s $20bn-odd in assets has actually been encouraged by the Fed's mortgages-for-Treasuries offer. Because the Fed’s new lending emergency lending facility allows the banks to swap mortgage-backed debt for Treasury Bills in a way that Carlyle could not do. <--Remember, you have to be a primary dealer.....Hedge funds aren't :)

If that’s the case, there will be some very scared people in hedge-fund land today. Hedge funds that have borrowed from banks against the security of mortgage-backed debt could be about to see their assets sucked into the banking system and their businesses vanish.

It’s a process known as de-leveraging the global financial economy, yet another manifestation of the puncturing of the debt bubble.

Dan Ross

http://www.BetterBizIdeas.com

Wednesday, March 12, 2008

Another disturbing consumer datapoint.

• Filings for Bankruptcy Up 18% in February http://www.nytimes.com/2008/03/05/business/05bankruptcy.html

Americans filed for bankruptcy in growing numbers in February, buckling under the combined weight of rising energy prices, a weakening housing market and sky-high personal debts.

An average of 3,960 bankruptcy petitions were filed per day nationwide last month, up 18 percent from January and up 28 percent from a year earlier, according to Automated Access to Court Electronic Records, a bankruptcy data and management company.

Dan Ross

http://www.BetterBizBooks.com

Americans filed for bankruptcy in growing numbers in February, buckling under the combined weight of rising energy prices, a weakening housing market and sky-high personal debts.

An average of 3,960 bankruptcy petitions were filed per day nationwide last month, up 18 percent from January and up 28 percent from a year earlier, according to Automated Access to Court Electronic Records, a bankruptcy data and management company.

Dan Ross

http://www.BetterBizBooks.com

Tuesday, March 11, 2008

Grocery prices / Inflation about to hit your wallet!

http://www.dallasnews.com/sharedcontent/dws/bus/stories/031008dnnatnufoodprices.3c19156.html?npc&nTar&ybz

Key Points from the article:

U.S. retail chicken prices in January were up 10 percent compared with a year before, while whole milk was up at least 20 percent and tomatoes 25 percent, according to the Bureau of Labor statistics.

Bread was up 5.4 percent nationally. Skyrocketing wheat prices mean higher flour prices, which means everything from pizza crust to cake are likely to see a price hike in the coming months.

And that side of egg salad? Not cheap. Eggs gained more than 30 percent.

Food accounts for about 13 percent of household spending, compared with about 4 percent for gas.

Food prices are rising while home values fall and the stock market falters – all of which can shake consumer confidence.

Wholesale food prices, an indicator of where supermarket prices are headed, rose last month at the fastest rate since 2003, with egg prices jumping 60 percent from a year ago, pasta products 30 percent and fruits and vegetables 20 percent, according to the Labor Department.

A whole shopping basket of factors are combining to make a trip to the market more costly.

Higher fuel prices make it costlier to grow crops and get them to market. Corn, a key foodstuff for farm animals, has shot up as ethanol demand increases. Corn prices have more than doubled in commodity markets over two years, and soybeans nearly tripled, according to DTN, a commodities-analysis firm in Omaha, Neb.

"The biggest factors have to do with the ever-increasing demand for food products combined with the weak dollar," Mr. Leibtag said.

In 2005, wheat averaged $3.50 to $4 per bushel on commodities markets, he said. By December, the price was $7.75, and in January it was $8.55. Futures markets predict a further increase.

Corn inflation has translated to higher meat prices.

Bottom Line is that the consumer, while starting to get worried, has really ignored this impact so far. Reporting on this topic has been SLIM TO NONE but it will really start to kick in sometime this spring/summer as inflation and gas prices keep prices climbing.

Dan Ross

http://www.BetterBizBooks.com

Key Points from the article:

U.S. retail chicken prices in January were up 10 percent compared with a year before, while whole milk was up at least 20 percent and tomatoes 25 percent, according to the Bureau of Labor statistics.

Bread was up 5.4 percent nationally. Skyrocketing wheat prices mean higher flour prices, which means everything from pizza crust to cake are likely to see a price hike in the coming months.

And that side of egg salad? Not cheap. Eggs gained more than 30 percent.

Food accounts for about 13 percent of household spending, compared with about 4 percent for gas.

Food prices are rising while home values fall and the stock market falters – all of which can shake consumer confidence.

Wholesale food prices, an indicator of where supermarket prices are headed, rose last month at the fastest rate since 2003, with egg prices jumping 60 percent from a year ago, pasta products 30 percent and fruits and vegetables 20 percent, according to the Labor Department.

A whole shopping basket of factors are combining to make a trip to the market more costly.

Higher fuel prices make it costlier to grow crops and get them to market. Corn, a key foodstuff for farm animals, has shot up as ethanol demand increases. Corn prices have more than doubled in commodity markets over two years, and soybeans nearly tripled, according to DTN, a commodities-analysis firm in Omaha, Neb.

"The biggest factors have to do with the ever-increasing demand for food products combined with the weak dollar," Mr. Leibtag said.

In 2005, wheat averaged $3.50 to $4 per bushel on commodities markets, he said. By December, the price was $7.75, and in January it was $8.55. Futures markets predict a further increase.

Corn inflation has translated to higher meat prices.

Bottom Line is that the consumer, while starting to get worried, has really ignored this impact so far. Reporting on this topic has been SLIM TO NONE but it will really start to kick in sometime this spring/summer as inflation and gas prices keep prices climbing.

Dan Ross

http://www.BetterBizBooks.com

Labels:

Dan Ross,

http://www.BetterBizIdeas.com,

inflation

Monday, March 3, 2008

Commercial Real Estate is now slowing down dramatically...

Now commercial development is slowing down quickly.....

"Spending on U.S. building projects in January fell by the most in 14 years as the housing slump worsened and construction slowed on hotels and highways. The 1.7 percent decrease, more than twice the fall economists forecast, followed a revised 1.3 percent drop in December that was steeper than initially reported, the Commerce Department said today in Washington. Construction spending has contracted for four straight months.

Homebuilding is in a third year of declines as sales weaken and builders halt new projects to lighten inventories.

Stricter borrowing rules and lower demand are also restraining commercial developers, creating an even greater drag on growth." <--This is what the FDIC is worried about as it then really puts the pinch on regional banks that might have overextended themselves to real estate development in the last few years. Are these banks capitalized properly to handle bad commercial loans and bad residential loans at the same time? Dan Ross http://betterbizbooks.com/

"Spending on U.S. building projects in January fell by the most in 14 years as the housing slump worsened and construction slowed on hotels and highways. The 1.7 percent decrease, more than twice the fall economists forecast, followed a revised 1.3 percent drop in December that was steeper than initially reported, the Commerce Department said today in Washington. Construction spending has contracted for four straight months.

Homebuilding is in a third year of declines as sales weaken and builders halt new projects to lighten inventories.

Stricter borrowing rules and lower demand are also restraining commercial developers, creating an even greater drag on growth." <--This is what the FDIC is worried about as it then really puts the pinch on regional banks that might have overextended themselves to real estate development in the last few years. Are these banks capitalized properly to handle bad commercial loans and bad residential loans at the same time? Dan Ross http://betterbizbooks.com/

Subscribe to:

Posts (Atom)