By now, if you haven't had your head in the sand, you know that the economy has been weakening due to a "housing bubble" and a "credit crisis" that are VERY real.

Well, everything I have been hearing/seeing lately indicates to me that the credit crisis is continuing to get MORE traction, not less, and that the economy will be weak for sometime. Those economic stimulus checks we got....well, they have been spent and things aren't improving much. Up until now the bulk of the slowdown has been related to the building/housing declining. With property values declining and foreclosures rising consumers have been pulling back their spending as well.

The secondary effect of the housing bubble was that international lenders and even domestic banks have really pulled back the amount of $$$ they are loaning to American consumers and the financing terms they are giving them. Higher interest rates, removal of existing credit limits, etc. are really pinching Americans more than I think everyone wants to admit.

Having said that, the below article from http://www.prospective.com/ really highlights how the average consumer is getting pinched.

http://www.prospectiv.com/news171.jsp

"While newspapers and magazines were the primary source of coupons for 51% of consumers, 39% said they wanted to receive their future coupons via direct mail, while 26% said e-mail, either direct or through newsletters, would work. Another 16% preferred Web sites. Newspapers trailed with 14% favoring the once prevalent way to obtain coupons."

"And the good news for newspapers: 47% found print and online coupons equally convenient, while just 9% reported online coupons were most convenient. "

Dan Ross

http://www.BetterBizIdeas.com

Sunday, August 31, 2008

Saturday, August 30, 2008

Top Mobile Browsing Nations

http://www.marketingcharts.com/interactive/us-mobile-web-surfing-about-to-surpass-uk-levels-5836/bango-top-10-mobile-web-countries-july-2008jpg/

So China will have the largest number of mobile users in the world soon. If they don't already.....

Europe has historically led the world in mobile penetration. Part of this is related to a history of POOR landline, where the countries use different wiring in homes (copper in U.S.) but aluminum and other lines have been used in Europe. Additionally, you have to remember that Europe's infrastructure is MUCH older (historic buildings cost a TON to retrofit so many never did) & they had TWO world wars on their turf, where much of the infrastructure was blown apart and never rebuild completely.

Getting back to the point.....

The U.S. is about to become the largest phone browsing nation in the world....Interesting little factoid. All we need now is to enable payments via cell phones (Like Japan/Europe) and we will exit the cell phone "dark ages."

Dan Ross

http://www.BetterBizIdeas.com

So China will have the largest number of mobile users in the world soon. If they don't already.....

Europe has historically led the world in mobile penetration. Part of this is related to a history of POOR landline, where the countries use different wiring in homes (copper in U.S.) but aluminum and other lines have been used in Europe. Additionally, you have to remember that Europe's infrastructure is MUCH older (historic buildings cost a TON to retrofit so many never did) & they had TWO world wars on their turf, where much of the infrastructure was blown apart and never rebuild completely.

Getting back to the point.....

The U.S. is about to become the largest phone browsing nation in the world....Interesting little factoid. All we need now is to enable payments via cell phones (Like Japan/Europe) and we will exit the cell phone "dark ages."

Dan Ross

http://www.BetterBizIdeas.com

Labels:

Cell phones,

China,

Dan Ross,

http://www.BetterBizIdeas.com

American Car Companies Look to Uncle Sam for $50 billion in loans

1) They don't build quality cars - I think they are building better ones now but that is the perception...like it or not

A new recall of 850k cars. So much for that I guess.....

http://www.reuters.com/article/hotStocksNews/idUSN2942792520080829

2) They haven't gotten the FOGGIEST CLUE how to brand a company. What does a GM or Ford Car stand for? Do you have any idea? Honda makes great engines, Toyota builds a great overall quality car that will last a long time, Nissan has power bang for the buck & some sexiness. Each of these companies also own a luxury brand like Acura, Lexus or Infiniti so their main brand only has so many luxury touches....

Anyway, here are some interesting articles.

Delphi's bankruptcy is going to cause big, big pension problems by the end of September. Expect GM to be in on that news.....

http://www.reuters.com/article/businessNews/idUSBNG11638920080829?feedType=nl&feedName=usbeforethebell&pageNumber=2&virtualBrandChannel=0

Then They are asking for tons more $$$ because they can only sell gas guzzling cars and failed to innovate or brand a car company.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bD3A3D245-E2A2-4151-B5AD-D29C39880EEB%7d&siteid=yhoof2

I understand how important this industry is to the U.S. infrastructure, ability to have an industrial presence (in case of war)......but what I see are politicians/free enterprise/trade allowing cheaper cars into this country in DROVES. We shouldn't enable the destruction of an industry with one hand and then try and save them (without any hope) with the other hand. Just seems rational to me. The bottom line is that there are more health care costs in a GM car than STEEL costs! U.S. auto manufacturers, if they produce here, are at a competitive disdadvantage without some forms of tariffs. And then this starts the whole free enterprise/trade dilemna.....YIKES!

Dan Ross

http://www.BetterBizIdeas.com

A new recall of 850k cars. So much for that I guess.....

http://www.reuters.com/article/hotStocksNews/idUSN2942792520080829

2) They haven't gotten the FOGGIEST CLUE how to brand a company. What does a GM or Ford Car stand for? Do you have any idea? Honda makes great engines, Toyota builds a great overall quality car that will last a long time, Nissan has power bang for the buck & some sexiness. Each of these companies also own a luxury brand like Acura, Lexus or Infiniti so their main brand only has so many luxury touches....

Anyway, here are some interesting articles.

Delphi's bankruptcy is going to cause big, big pension problems by the end of September. Expect GM to be in on that news.....

http://www.reuters.com/article/businessNews/idUSBNG11638920080829?feedType=nl&feedName=usbeforethebell&pageNumber=2&virtualBrandChannel=0

Then They are asking for tons more $$$ because they can only sell gas guzzling cars and failed to innovate or brand a car company.

http://www.marketwatch.com/News/Story/Story.aspx?guid=%7bD3A3D245-E2A2-4151-B5AD-D29C39880EEB%7d&siteid=yhoof2

I understand how important this industry is to the U.S. infrastructure, ability to have an industrial presence (in case of war)......but what I see are politicians/free enterprise/trade allowing cheaper cars into this country in DROVES. We shouldn't enable the destruction of an industry with one hand and then try and save them (without any hope) with the other hand. Just seems rational to me. The bottom line is that there are more health care costs in a GM car than STEEL costs! U.S. auto manufacturers, if they produce here, are at a competitive disdadvantage without some forms of tariffs. And then this starts the whole free enterprise/trade dilemna.....YIKES!

Dan Ross

http://www.BetterBizIdeas.com

Labels:

auto sales,

Business News,

Dan Ross,

Ford,

GM,

http://www.BetterBizIdeas.com,

Investing

Chinese Stocks to Double....Street.com link

The video below talks about how Chinese stocks are being SIGNIFICNATLY undervalued right now. I 100% agree with him.

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=289004&cl=9469944&src=finance&ch=633473

Additionally, a new Earthquake in China, of 6.2 magnitude. Last time that happened CPSL stock soared due to thoughts re: re-building and the need for steel. Granted, it should help GSI more than CPSL as CPSL primarily is involved in sheet metal (think appliances, end devices and not steel beams.)

http://news.yahoo.com/s/ap/20080831/ap_on_re_as/china_earthquake

Dan

http://www.BetterBizIdeas.com

http://cosmos.bcst.yahoo.com/up/player/popup/?rn=289004&cl=9469944&src=finance&ch=633473

Additionally, a new Earthquake in China, of 6.2 magnitude. Last time that happened CPSL stock soared due to thoughts re: re-building and the need for steel. Granted, it should help GSI more than CPSL as CPSL primarily is involved in sheet metal (think appliances, end devices and not steel beams.)

http://news.yahoo.com/s/ap/20080831/ap_on_re_as/china_earthquake

Dan

http://www.BetterBizIdeas.com

Some Economics of Food.....for thought :) UPDATE

This is an update with some updated factoids for people to chew on.....VERY interesting numbers

from http://www.pigsite.com/

"Processing is the most vulnerable player in the Canadian pork industry today, says Bouma, with the U.S. holding a significant advantage in terms of capacity and labour intensity. Comparing the productivity of the top U.S. and Canadian processors highlights this gap. Today, the U.S.’s largest 29 plants process 21,000 hogs per day while Canada’s largest 29 produce an average of 3,200 hogs per day. The result? U.S. producers put an estimated six to 10 more dollars in their wallets per hog sold compared to their Canadian counterparts. "

So how does this compare to Chinese Pork/Production???

From HOGS/FEED (two chinese pork raisers/processors). Here are their recent filings. Both companies are growing ENORMOUSLY. Wall Street seems to indicate that HOGS is the most undervalued of the two.

HOGS

http://biz.yahoo.com/prnews/080811/cnm010.html?.v=59

FEED

AgFeed Industries bought 4 more Hog Farms recently and has been consolidating the industry throughout China.

From http://www.forbes.com/

http://www.forbes.com/2008/08/22/china-agricultural-imports-markets-econ-cx_tw_0821markets29.html?partner=yahootix

"Given the rapid rise in food prices in China amid increasing wealth, investors could stand to gain from exposure to U.S.-listed Chinese companies with 90% to 100% exposure to China, such as AgFeed Industries (nasdaq: FEED - news - people ), American Dairy (nyse: ADY - news - people ), HQ Sustainable Marine Industries (amex: HQS - news - people ), Synutra International (nasdaq: SYUT - news - people ) and Zhongpin (nasdaq: HOGS - news - people )."

I saved the best udpate for last :) Looks like this company is hiring some a very senior american to help develop its company.

http://biz.yahoo.com/iw/080820/0426486.html

"NASDAQ Global Market listed AgFeed Industries (http://www.agfeedinc.com/) is a US company with its primary operations in China. AgFeed has two profitable business lines -- premix animal feed and hog production. AgFeed is China's largest commercial hog producer in terms of total annual hog production as well as the largest premix feed company in terms of revenues. China is the world's largest hog producing country that produces over 600 million hogs per year, compared to approximately 100 million hogs in the US. China also has the world's largest consumer base for pork consumption. Over 65% of total meat consumed in China is pork. Hog production in China enjoys income tax free status. The pre-mix feed market in which AgFeed operates is an approximately $1.6 billion segment of China's $40 billion per year animal feed market, according to the China Feed Industry Association."

Original Post

China, 1995: average person eats 55 lbs of meat per year. China, 2007: average person eats 116 lbs of meat per year. Here is what I can't tell you. What kind of meat?

It takes 15 lbs of grain to produce 1 lb of meat. According to expert figures, China has increased grain requirements to 350 million metric tonnes in 2007 from 150 just 12 years earlier. That’s a +133% increase just so the average Chinese citizen can enjoy more meat.

Fertilizer is used to produce grain to feed the animals – in fact, for every pound of beef produced, a steer must consume 15 pounds of grain. This further drives up the demand and the cost of fertilizer. So we can understand why there is a demand for more fertilizers and why stocks such as Potash, Mosaic, etc. are going through the roof right now.

How much feed does a pig need though? I'll get that in the upcoming days.....Info. re: beef isn't applicable. Why?

Pork occupies a special place in the Chinese diet and economy. It is estimated that the Chinese consume more pork than any other nation. This makes sense given that pork is also estimated to account for two-thirds of the average Chinese's protein intake. According to this article below

http://www.smallcapinvestor.com/smallcapinsights/china/2008-07-17-check_on_china_agfeed_industries

"It is prepared in almost every conceivable way, from roasted whole suckling pigs, commonly served during holiday .easts, to sweet and sour pork, whose Americanized version is a Chinese restaurant staple."

Dan Ross

http://www.BetterBizIdeas.com

from http://www.pigsite.com/

"Processing is the most vulnerable player in the Canadian pork industry today, says Bouma, with the U.S. holding a significant advantage in terms of capacity and labour intensity. Comparing the productivity of the top U.S. and Canadian processors highlights this gap. Today, the U.S.’s largest 29 plants process 21,000 hogs per day while Canada’s largest 29 produce an average of 3,200 hogs per day. The result? U.S. producers put an estimated six to 10 more dollars in their wallets per hog sold compared to their Canadian counterparts. "

So how does this compare to Chinese Pork/Production???

From HOGS/FEED (two chinese pork raisers/processors). Here are their recent filings. Both companies are growing ENORMOUSLY. Wall Street seems to indicate that HOGS is the most undervalued of the two.

HOGS

http://biz.yahoo.com/prnews/080811/cnm010.html?.v=59

FEED

AgFeed Industries bought 4 more Hog Farms recently and has been consolidating the industry throughout China.

From http://www.forbes.com/

http://www.forbes.com/2008/08/22/china-agricultural-imports-markets-econ-cx_tw_0821markets29.html?partner=yahootix

"Given the rapid rise in food prices in China amid increasing wealth, investors could stand to gain from exposure to U.S.-listed Chinese companies with 90% to 100% exposure to China, such as AgFeed Industries (nasdaq: FEED - news - people ), American Dairy (nyse: ADY - news - people ), HQ Sustainable Marine Industries (amex: HQS - news - people ), Synutra International (nasdaq: SYUT - news - people ) and Zhongpin (nasdaq: HOGS - news - people )."

I saved the best udpate for last :) Looks like this company is hiring some a very senior american to help develop its company.

http://biz.yahoo.com/iw/080820/0426486.html

"NASDAQ Global Market listed AgFeed Industries (http://www.agfeedinc.com/) is a US company with its primary operations in China. AgFeed has two profitable business lines -- premix animal feed and hog production. AgFeed is China's largest commercial hog producer in terms of total annual hog production as well as the largest premix feed company in terms of revenues. China is the world's largest hog producing country that produces over 600 million hogs per year, compared to approximately 100 million hogs in the US. China also has the world's largest consumer base for pork consumption. Over 65% of total meat consumed in China is pork. Hog production in China enjoys income tax free status. The pre-mix feed market in which AgFeed operates is an approximately $1.6 billion segment of China's $40 billion per year animal feed market, according to the China Feed Industry Association."

Original Post

China, 1995: average person eats 55 lbs of meat per year. China, 2007: average person eats 116 lbs of meat per year. Here is what I can't tell you. What kind of meat?

It takes 15 lbs of grain to produce 1 lb of meat. According to expert figures, China has increased grain requirements to 350 million metric tonnes in 2007 from 150 just 12 years earlier. That’s a +133% increase just so the average Chinese citizen can enjoy more meat.

Fertilizer is used to produce grain to feed the animals – in fact, for every pound of beef produced, a steer must consume 15 pounds of grain. This further drives up the demand and the cost of fertilizer. So we can understand why there is a demand for more fertilizers and why stocks such as Potash, Mosaic, etc. are going through the roof right now.

How much feed does a pig need though? I'll get that in the upcoming days.....Info. re: beef isn't applicable. Why?

Pork occupies a special place in the Chinese diet and economy. It is estimated that the Chinese consume more pork than any other nation. This makes sense given that pork is also estimated to account for two-thirds of the average Chinese's protein intake. According to this article below

http://www.smallcapinvestor.com/smallcapinsights/china/2008-07-17-check_on_china_agfeed_industries

"It is prepared in almost every conceivable way, from roasted whole suckling pigs, commonly served during holiday .easts, to sweet and sour pork, whose Americanized version is a Chinese restaurant staple."

Dan Ross

http://www.BetterBizIdeas.com

Labels:

China,

chinese small caps,

Chinese Stocks,

Dan Ross,

http://www.BetterBizIdeas.com,

MOS,

Mosaic,

POT,

Potash

The economy keeps on growing...

From http://www.tippingpointstocks.com/

"a recession is two consecutive quarters of negative GDP growth. When the first quarter results showed a gain, not negative growth, the refrain from the bears was that the economy's current problems, credit liquidity and housing, were too recent to be reflected in Q1 numbers. "We're in a recession, all right, but the government numbers will take time to catch up," they said.

So when preliminary Q2 numbers came out at a POSITIVE 1.9%, the bears were somewhat befuddled. And they really didn't like it when the forecasted numbers for yesterday's GDP was raised from 1.9% to an expected annualized growth rate of 2.7%. You can only imagine the bears' dismay, then, when the Commerce Department raised the Q2 estimate even further than expected — to 3.3%. And the stock market erupted on the news, with the Dow Industrials gaining 1.6% yesterday."

Interesting alright...VERY interesting.....

" The economy, despite all odds, continues to grow, at an expanding rate.And the stock market has reflected almost none of this, as it remains distracted by housing and credit market concerns. Those concerns remain a market issue, not because of the depth of those problems, but because of investor concern that we haven't heard the complete story yet. The market can handle just about anything except uncertainty. Once the magnitude of the housing problem and the credit problem are on the table, you can expect the market to rally."

I for one am of the opinion that the economy is growing (but slowing) and it is whipsawing around like no tomorrow. The U.S. gov't is attempting to inject liquidity into the markets like NO tomorrow while constantly walking the tightrope with preserving the U.S. dollar by keeping interest rates flat (not cutting them.) I think the next president will be the one inheriting a recession and the biggest budget deficit in the history of the U.S.

Dan Ross

http://www.BetterBizIdeas.com

"a recession is two consecutive quarters of negative GDP growth. When the first quarter results showed a gain, not negative growth, the refrain from the bears was that the economy's current problems, credit liquidity and housing, were too recent to be reflected in Q1 numbers. "We're in a recession, all right, but the government numbers will take time to catch up," they said.

So when preliminary Q2 numbers came out at a POSITIVE 1.9%, the bears were somewhat befuddled. And they really didn't like it when the forecasted numbers for yesterday's GDP was raised from 1.9% to an expected annualized growth rate of 2.7%. You can only imagine the bears' dismay, then, when the Commerce Department raised the Q2 estimate even further than expected — to 3.3%. And the stock market erupted on the news, with the Dow Industrials gaining 1.6% yesterday."

Interesting alright...VERY interesting.....

" The economy, despite all odds, continues to grow, at an expanding rate.And the stock market has reflected almost none of this, as it remains distracted by housing and credit market concerns. Those concerns remain a market issue, not because of the depth of those problems, but because of investor concern that we haven't heard the complete story yet. The market can handle just about anything except uncertainty. Once the magnitude of the housing problem and the credit problem are on the table, you can expect the market to rally."

I for one am of the opinion that the economy is growing (but slowing) and it is whipsawing around like no tomorrow. The U.S. gov't is attempting to inject liquidity into the markets like NO tomorrow while constantly walking the tightrope with preserving the U.S. dollar by keeping interest rates flat (not cutting them.) I think the next president will be the one inheriting a recession and the biggest budget deficit in the history of the U.S.

Dan Ross

http://www.BetterBizIdeas.com

Friday, August 29, 2008

Small Cap Returns in August

From http://www.smallcapinvestor.com/

"Small-cap stocks in China posted double-digit losses on average during August, while small caps in India were virtually unchanged in the month through Aug. 25, according to a Press Trust of India report that cited data from Citigroup Global. For the region as a whole, 80% of all Asian stocks posted negative returns, with a median loss of 8.1%."

I'll follow that up by saying I found MANY, MANY chinese stocks that were down 40%-60%. I have noticed quite a few chinese small cap stocks that were posting 100% - 200% growth rates (some organic growth....others through acquisition) slowing their growth rates to 10%-30%. As consolidation in their economy & overall economy are slowing many investors are growing wary of chinese small cap stocks.

I still think there are a TON of good stocks to be found and then traded from time to time. Some should be held for the long-term. I'll be posting a listing of some of interesting finds I have come across in the next few weeks.

Dan Ross

http://www.betterbizbooks.com/

"Small-cap stocks in China posted double-digit losses on average during August, while small caps in India were virtually unchanged in the month through Aug. 25, according to a Press Trust of India report that cited data from Citigroup Global. For the region as a whole, 80% of all Asian stocks posted negative returns, with a median loss of 8.1%."

I'll follow that up by saying I found MANY, MANY chinese stocks that were down 40%-60%. I have noticed quite a few chinese small cap stocks that were posting 100% - 200% growth rates (some organic growth....others through acquisition) slowing their growth rates to 10%-30%. As consolidation in their economy & overall economy are slowing many investors are growing wary of chinese small cap stocks.

I still think there are a TON of good stocks to be found and then traded from time to time. Some should be held for the long-term. I'll be posting a listing of some of interesting finds I have come across in the next few weeks.

Dan Ross

http://www.betterbizbooks.com/

Thursday, August 28, 2008

Most Affluent City in America ....Plano ???

http://www.usatoday.com/news/nation/census/2008-08-26-income-side_N.htm?se=yahoorefer

Thought everyone might find this article interesting. I don't find it surprising that it would be in the top 20, even the top 10 in America but the MOST affluent city? Come on now!

What I don't understand is how the number increased by 10% for an ENTIRE CITY in one year. That number just smells wrong.

For the record, I work in Plano but live to the north in poor Frisco I guess :)

Dan

http://www.BetterBizIdeas.com

Thought everyone might find this article interesting. I don't find it surprising that it would be in the top 20, even the top 10 in America but the MOST affluent city? Come on now!

What I don't understand is how the number increased by 10% for an ENTIRE CITY in one year. That number just smells wrong.

For the record, I work in Plano but live to the north in poor Frisco I guess :)

Dan

http://www.BetterBizIdeas.com

Sunday, August 24, 2008

U.S. Citizenship - About darn time!

I moved here when I was 4 and I've had a greencard as long as I can recall. This past Tuesday I was sworn in as a U.S. Citizen.

This is a HUGE day for me.

1) If I die Uncle Sam can't take 50% immediately just for being a foreigner. Apparently there are HUGE tax implications for wealthy foreigners dying here. 50% * $0 = $0, right? LOL Nonetheless, I am not some wealthy foreigner....

2) I can't be sent back to Canada, where I was born. I hate the cold and enjoy the warmth. I'll take a Texas summer over a Canadian winter anytime :)

Dan Ross

http://www.BetterBizBooks.com

This is a HUGE day for me.

1) If I die Uncle Sam can't take 50% immediately just for being a foreigner. Apparently there are HUGE tax implications for wealthy foreigners dying here. 50% * $0 = $0, right? LOL Nonetheless, I am not some wealthy foreigner....

2) I can't be sent back to Canada, where I was born. I hate the cold and enjoy the warmth. I'll take a Texas summer over a Canadian winter anytime :)

Dan Ross

http://www.BetterBizBooks.com

Tuesday, August 19, 2008

Things changing in Macau?? WHOA!

Gaming stocks got pounded today, based on the article below, on news that mainland Chinese will only be able to visit the place twice a year vs. currently allowed to visit the island about 6 times or so per year.

http://biz.yahoo.com/rb/080819/casino_stocks.html?.v=1

This clearly has put a ceiling on the expectations surrounding gaming stocks. MGM Mirage (MGM), Las Vegas Sands (Venetian Owners: LVS) & Wynn Resorts (WYNN) got hammered today. Oh, and that really puts a dent on me going into Melco (MPEL), which I mentioned a few days ago. I think I'll be holding off on investing until all the analysts take their EPS estimates down and downward pressure in the shares slow down.

Dan Ross

http://www.betterbizbooks.com/

http://biz.yahoo.com/rb/080819/casino_stocks.html?.v=1

This clearly has put a ceiling on the expectations surrounding gaming stocks. MGM Mirage (MGM), Las Vegas Sands (Venetian Owners: LVS) & Wynn Resorts (WYNN) got hammered today. Oh, and that really puts a dent on me going into Melco (MPEL), which I mentioned a few days ago. I think I'll be holding off on investing until all the analysts take their EPS estimates down and downward pressure in the shares slow down.

Dan Ross

http://www.betterbizbooks.com/

ABAT takes it on the chin today

A few days ago I commented that I thought ABAT (Advanced Battery Technologies) would likely trend downwards towards $4.00 and then likely $3.75.

Well, I didn't expect it to come so soon! ABAT hit $3.75 today as the stock price gapped down today on negative U.S. PPI data and other weak economic news. While the stock price recovered and closed near intraday highs I think $3.75 levels will be re-tested and I am concerned the stock might make a run through those levels and head to $3.00.

Well, I didn't expect it to come so soon! ABAT hit $3.75 today as the stock price gapped down today on negative U.S. PPI data and other weak economic news. While the stock price recovered and closed near intraday highs I think $3.75 levels will be re-tested and I am concerned the stock might make a run through those levels and head to $3.00.

I have cash going into my trading account (from savings) for such an event. I think that ABAT raised their outstanding shares by 6% but capacity by 165%. Given that the shares were issued near $4.50 and options near $5.50 I am HIGHLY confident re: future potential upside in the shares from today's levels. Nonetheless, I'll be patient and wait.

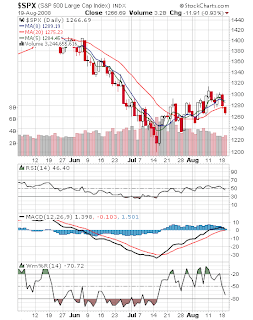

Why wait? I think the stock market is rolling over and going to re-test lows see in July.

The financials appear to be getting beaten up again on concerns of liquidity again.

Why wait? I think the stock market is rolling over and going to re-test lows see in July.

The financials appear to be getting beaten up again on concerns of liquidity again.

Given all the recent settlements re: auction rate securities and other bond related items such a concern seems logical. I am not sure re: everyone's capitalization but additional bank failures are HIGHLY likely based on what the FDIC has been saying.

Dan Ross

Thursday, August 14, 2008

Gulf Resources (GFRE.OB) - up 40% today. Reversal??

Bulletin Board stocks....YUCK!

But when I see annualized revenue of $100 million, EPS of .25 for the year, a growing market (chinese demand), a license to grow from the government (only 6 companies have Bromine mining licenses and there are TONS of them that are being bought out right now that are NOT licensed. That makes for good prices :) )

GFRE mines/produces Bromine, a chemical used in many daily uses. As some stock became free to sell (previous acquisitions/consulting) apparently it was sold at ALL COST, and hammerred the stock price.

The company has retained a new IR firm, http://www.ccgelite.com/ and announced 2Q results earlier today at 100% top line and 100% bottom line growth.

With $0.25 in EPS, good cash flow from operations (negative cash flow due to acquisitions/debt) the company could easily trade at $2.50 to $5.00 based on my calcs (10x to 20x multiple)

Here are some other ways of looking at it

$84 million to $90 million in sales this year with 100 million shares = .84 per share at 1x sales or 1.68 at 2x sales. With EPS of .25 trading at 3x EPS is RIDICULOUS and I think a 10x multiple is conservative, making it a triple from today's closing price of $0.85. I bought 3000 shares at $0.63 the other day, which is looking pretty good right now. Having said that, I bought some on the way down at $.80, .70 and .60. When the stock hit $.48 I thought I was going to throw up as I didn't "know something" but I feel better after seeing the published reports/SEC fililings and new IR firm coming on board.

It took the stock 11 days to decline from 1.80 to .60 and the company DID NOT comment at all, which was VERY frustrating for investors. I am very curious to see where the stock will end up in a month or two from now but, after today's EPS results were announced, the stock jumped 40%. I think a run to $1.00 seems quick and $1.20 seems possible in the next few days. I would love to see $1.80 in eleven trading days (just like the decline) but I don't know how many buyers will come out of the woodwork to buy the stock.

Dan Ross

Melco Update (MPEL)

I discussed Melco on a July 17th posting re: how the stocks were getting DESTROYED. I haven't bought any stock in the company but I am going to when I get some free cash. Long-term type of holding for those with disposable cash and a more speculative risk/reward bent.

2Q EPS out - The stock jumped on HUGE volume.

http://biz.yahoo.com/pz/080814/148633.html

This might be the initial breakout for the stock. HUGE growth in EBITDA, revenue, etc. This is a leveraged company but I like the play on Chinese gaming (Macau) and this is the best pure play. Seems like a good point to be buying shares to me.

Motley Fool also seems to think this stock might double

2Q EPS out - The stock jumped on HUGE volume.

http://biz.yahoo.com/pz/080814/148633.html

This might be the initial breakout for the stock. HUGE growth in EBITDA, revenue, etc. This is a leveraged company but I like the play on Chinese gaming (Macau) and this is the best pure play. Seems like a good point to be buying shares to me.

Motley Fool also seems to think this stock might double

http://www.fool.com/investing/high-growth/2008/08/14/these-stocks-could-be-your-next-two-bagger.aspx

Definitely worth doing some Due Diligence on....

Dan Ross

Great link on stocks that could double in China

http://www.stockpickr.com/problog/856/

Giant Interactive (GA) is on my radar but I have too much capital tied up in Gulf Resources (GFRE.OB) right now to purchase any shares. I agree with their philosophy re: GA. Definitely undervalued......the play is social networking in China + continued game development. It wouldn't surprise me, over the long-term, if most of the value of the company became dominated by their investment in http://www.51.com/, a chinese social networking company.

CPSL is mentioned in the above article as well :)

Giant Interactive (GA) is on my radar but I have too much capital tied up in Gulf Resources (GFRE.OB) right now to purchase any shares. I agree with their philosophy re: GA. Definitely undervalued......the play is social networking in China + continued game development. It wouldn't surprise me, over the long-term, if most of the value of the company became dominated by their investment in http://www.51.com/, a chinese social networking company.

CPSL is mentioned in the above article as well :)

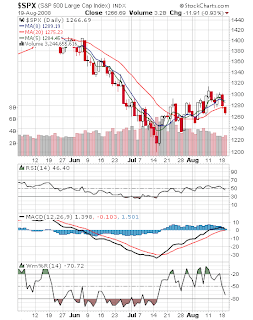

Here are a few charts of CPSL, which was up 9% today on their 2Q EPS announcement. The stock appears to be ready to begin a weekly uptrend, coming out of an oversold condition. The daily charts started ROCKING and ROLLING today on strong volume.

The CEO of CPSL owns 45% of the company so hopefuly his interests are aligned with shareholders :)

Wednesday, August 13, 2008

ABAT - trading action not looking good

I should have posted this earlier but I liquidated my ABAT position so that I could buy another stock. I thought there was greater upside with the other stock, ABAT trading / momentum had slowed and I was getting skittish re: lack of continued movement upwards. When the 5 day moving average went below the 20 day moving average (crossed negatively) I got worried.

So what happened? I sold around $5.50 and then the company came out and announced a secondary offering. That offering, at $4.40 or so per share, took the stock down. The company needs cash to retrofit buildings C & D (currently empty) and to retrofit their A & B buildings to increase capacity/efficiency. When everything is said and done their capacity will go up by 165%.

Now, if I was them I would have taken on DEBT as the stock was undervalued, sold at TOO low of a price, and diluted existing shareholders. Since then the stock has been sliding and is near $4.50 today and likely headed to $4.25 very shortly with $3.75 possible based on previous trading action.

I will step in and buy some shares after I see a bottom as I think the company's business is phenomenal and I think these guys are really plugged in close with the PRC gov't officials, which should help them in getting contracts. They will be moving out of small batteries into larger capacity batteries trying to lure large auto manufacturers to utilize them. They currently sell their product to motorcycle companies, electric bike companies (HUGE market in China) and Zap Auto (http://www.zap.com/). I'll be revising my target price here in the next few weeks after I look at their recent EPS announcement closer. Revenue growth has slowed to 53% annual but Y-Y EPS growth is 100% +.

http://biz.yahoo.com/pz/080811/148341.html

Dan Ross

http://www.BetterBizIdeas.com

Sunday, August 3, 2008

U.S. $$ vs. Euro - 10 year Chart

Interesting Chart of the Euro vs. the U.S. Dollar.

Back in 2001 each U.S. $$$ was worth nearly 1.2 Euros. Today, each U.S. Dollar is worth about .70 Euros.

That is what happens when you run deficits year after year after year after year, with no prospect of things improving. At some point the U.S. gov't has to stop the insanity because inflation is now creeping into the pocketbooks of Americans and people throughout the world as most commodities are priced in U.S. Dollars. So, as the $$$ drops EVERYTHING gets more expensive to us and to many foreigners as well.....Not all of them though :)

Back in 2001 each U.S. $$$ was worth nearly 1.2 Euros. Today, each U.S. Dollar is worth about .70 Euros.

That is what happens when you run deficits year after year after year after year, with no prospect of things improving. At some point the U.S. gov't has to stop the insanity because inflation is now creeping into the pocketbooks of Americans and people throughout the world as most commodities are priced in U.S. Dollars. So, as the $$$ drops EVERYTHING gets more expensive to us and to many foreigners as well.....Not all of them though :)

Dan Ross

Subscribe to:

Posts (Atom)