The federal government has no other choice but to put forth a massive bailout plan.

When the fed does this the value of the dollar is going to decline, which will cause the prices of commodities (oil in this case) to go higher.

This will cause a long-term demand for alternative energy products. This isn't some short-term fad.

I expect solar stocks to start taking off here in the next few weeks. I'll post some charts later tonight showing how they are bottoming out and set for a take-off.

The price of oil was trading at a low of $91.11 a barrel on September 17 and it closed at $108 or so on Friday, Sept 26th. That's a gain of 18% in a week or so.

Dan Ross

http://www.BetterBizIdeas.com

Monday, September 29, 2008

Sunday, September 28, 2008

Oil and Gas Companies DOMINATE Fortune's Fastest Growing Companies

http://money.cnn.com/magazines/fortune/fortunefastestgrowing/2008/full_list/

Sigma designs designs blu-ray chips. Intuitive Surgical.....from there TONS of energy companies, from drillers/developers to service companies, etc.

Texas obviously had the most listed in the top 100 due to the energy companies :)

Texas had 25, California had 18 and NY had 8. That is 51 total of the top 100 companies! Then, if you look at those state's populations it also helps to explain it :) NY is surprising to me given the high tax rate. CA obviously is Silicon Valley driven....

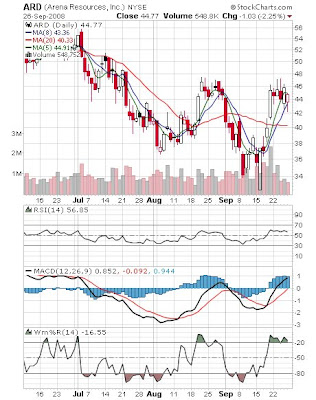

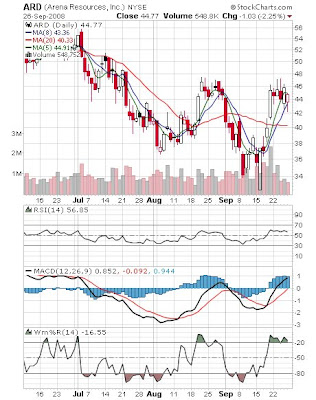

#1 company, Arena Resources, looks interesting re: analyst targets, fast growing, etc. Here is a chart. A weekly close above $46 would be considered bullish from a technical perspective. Highest analyst target is $80 and avg is $65 or so. It is about a $45 stock today.

Sigma designs designs blu-ray chips. Intuitive Surgical.....from there TONS of energy companies, from drillers/developers to service companies, etc.

Texas obviously had the most listed in the top 100 due to the energy companies :)

Texas had 25, California had 18 and NY had 8. That is 51 total of the top 100 companies! Then, if you look at those state's populations it also helps to explain it :) NY is surprising to me given the high tax rate. CA obviously is Silicon Valley driven....

#1 company, Arena Resources, looks interesting re: analyst targets, fast growing, etc. Here is a chart. A weekly close above $46 would be considered bullish from a technical perspective. Highest analyst target is $80 and avg is $65 or so. It is about a $45 stock today.

Dan Ross

http://www.BetterBizIdeas.com

http://www.BetterBizIdeas.com

Wednesday, September 24, 2008

S&P 500 Rolling Over- Retest of Lows Likely to Happen.

S&P 500 is rolling over again with the charts breaking through short-term support and we never really got above any weekly downtrend levels (breaking the 20 day moving average.)

A re-test of last week’s lows is likely

Dan Ross

Labels:

Dan Ross,

http://www.BetterBizIdeas.com,

Investing

Sunday, September 21, 2008

Last week's markets......

So last week the stock market declined to new 52 week lows, only to soar again after the U.S. Government promised to bail out everyone with a "package/plan" estimated to cost U.S. taxpayers $700 million to $1 billion. The "cost" is tough to estimate as it will be determined years from now when profits/gains from the plan are determined. The downside of not doing something is that the U.S. stock market will probably drop in value somewhere in the TRILLIONS :) What remains to be seen is what impact this will have on the U.S. dollar, which has appreciated quite a bit over the last 2 months, recovering 1/2 of its declines vs. other currencies over the last 1.5 years.

So lets review the drama:

1) Fannie / Freddie get taken over by the U.S. government (after global monetary advisors were threatening to pull out billions of $$$ from the U.S. market. This effectively wiped out their shareholders and a U.S. Government advisor will now run the company.....

2) Merrill Lynch agreed to be bought by Bank of America for $44 to $50 billion. ML shareholders haven't approved the deal but they should agree to do the deal. This will put together the biggest retail broker company with the biggest bank distribution and the biggest mortgage company in the U.S. Oh yeah, and they are #2 or #3 in credit cards as well......The combined business will be ENORMOUS with some serious cross-selling capabilities. I have no doubt that the Merrill Lynch name will stay after the merger as it has SERIOUS brand equity. It will be Merrill Lynch, a Bank of America company.

3) WAMU - nobody loves them. Their deposits will keep them afloat for the immediate future but, if their losses in CA/FL continue to increase, they could end up going BK due having ZERO equity or via falling below federal government threshhold's for banks. Everyone watches eagerly to see if account holders begin to take deposits out of the bank and move them to other banks.

4) AIG apparently had assets but they weren't liquid assets and their business model needs liquidity/access to capital. When short-term funding market seized up it forced them to have some serious problems. The government apparently gave them a bridge loan, taking an 80% equity stake in the company. AIG, from what everyone seems to be saying, might be viable; it will just take a few months/up to a year for assets to be sold to pay down the bridge loan. When everything is said and done AIG will be a shell of what it is today but people might actually be able to figure out how the company really makes $$$ and how to assess the companies value by looking at debt vs. assets, which seemed to be why most analysts missed downgrading the company way before it ran into problems.

5) Goldman Sachs / Morgan Stanley - As of today I hear they are likely bank holding companies

http://biz.yahoo.com/ap/080921/bank_change.html

6) Finally, Jim Cramer on CNBC was telling folks to sell up to 20% of their assets based on the stock market's recovery on Thursday/Friday. He seems to think that these rallies should be sold into and that the market turbulence will continue for some time.

http://www.cnbc.com/id/15840232?video=861375679&play=1

Dan Ross

http://www.BetterBizIdeas.com

Alt ED: 9-22-08 - Market down 375 and the U.S. dollar falling leads to soaring commodity prices. Oil spiked as much as $25 today alone. Can anyone say inflation? Here we go again....another shock to the system....

So lets review the drama:

1) Fannie / Freddie get taken over by the U.S. government (after global monetary advisors were threatening to pull out billions of $$$ from the U.S. market. This effectively wiped out their shareholders and a U.S. Government advisor will now run the company.....

2) Merrill Lynch agreed to be bought by Bank of America for $44 to $50 billion. ML shareholders haven't approved the deal but they should agree to do the deal. This will put together the biggest retail broker company with the biggest bank distribution and the biggest mortgage company in the U.S. Oh yeah, and they are #2 or #3 in credit cards as well......The combined business will be ENORMOUS with some serious cross-selling capabilities. I have no doubt that the Merrill Lynch name will stay after the merger as it has SERIOUS brand equity. It will be Merrill Lynch, a Bank of America company.

3) WAMU - nobody loves them. Their deposits will keep them afloat for the immediate future but, if their losses in CA/FL continue to increase, they could end up going BK due having ZERO equity or via falling below federal government threshhold's for banks. Everyone watches eagerly to see if account holders begin to take deposits out of the bank and move them to other banks.

4) AIG apparently had assets but they weren't liquid assets and their business model needs liquidity/access to capital. When short-term funding market seized up it forced them to have some serious problems. The government apparently gave them a bridge loan, taking an 80% equity stake in the company. AIG, from what everyone seems to be saying, might be viable; it will just take a few months/up to a year for assets to be sold to pay down the bridge loan. When everything is said and done AIG will be a shell of what it is today but people might actually be able to figure out how the company really makes $$$ and how to assess the companies value by looking at debt vs. assets, which seemed to be why most analysts missed downgrading the company way before it ran into problems.

5) Goldman Sachs / Morgan Stanley - As of today I hear they are likely bank holding companies

http://biz.yahoo.com/ap/080921/bank_change.html

6) Finally, Jim Cramer on CNBC was telling folks to sell up to 20% of their assets based on the stock market's recovery on Thursday/Friday. He seems to think that these rallies should be sold into and that the market turbulence will continue for some time.

http://www.cnbc.com/id/15840232?video=861375679&play=1

Dan Ross

http://www.BetterBizIdeas.com

Alt ED: 9-22-08 - Market down 375 and the U.S. dollar falling leads to soaring commodity prices. Oil spiked as much as $25 today alone. Can anyone say inflation? Here we go again....another shock to the system....

Saturday, September 20, 2008

Chinese Milk Scare! Interesting link

http://seekingalpha.com/article/95885-synutra-goes-beyond-government-orders-in-infant-formula-recall

"A second child in China has died after being given tainted infant formula, and more than a thousand other children became sick from various forms of the product. China’s Ministry of Health has determined the problem lies in the chemical additive melamine. The chemical is never supposed to be used in infant formula, but its addition increases the reading levels of protein in milk, though not the actual amount of protein. The MOH theorizes that the chemical was added by collection centers, rather than individual farmers or formula companies.

The scandal reminds the worldwide public of safety problems caused by poor regulation in China-sourced food and drugs, even though China-produced formula is not exported. The milk powder that caused the problem came from the Sanlu Group, one of the largest producers of dairy producers in China. Sanlu recalled its milk powder last week. However, there have been complaints of problems for almost six months. The first child died on May 1 and the second on July 22. The long time lag has caused complaining in some quarters that the company has been dragging its feet before taking this drastic action. The action is certainly drastic: the MOH says that over 10,000 tons of milk powder have been recalled.

Melamine was also the culprit in the China dog food scandal that occurred last year. "

Dan Ross

http://www.BetterBizIdeas.com/

"A second child in China has died after being given tainted infant formula, and more than a thousand other children became sick from various forms of the product. China’s Ministry of Health has determined the problem lies in the chemical additive melamine. The chemical is never supposed to be used in infant formula, but its addition increases the reading levels of protein in milk, though not the actual amount of protein. The MOH theorizes that the chemical was added by collection centers, rather than individual farmers or formula companies.

The scandal reminds the worldwide public of safety problems caused by poor regulation in China-sourced food and drugs, even though China-produced formula is not exported. The milk powder that caused the problem came from the Sanlu Group, one of the largest producers of dairy producers in China. Sanlu recalled its milk powder last week. However, there have been complaints of problems for almost six months. The first child died on May 1 and the second on July 22. The long time lag has caused complaining in some quarters that the company has been dragging its feet before taking this drastic action. The action is certainly drastic: the MOH says that over 10,000 tons of milk powder have been recalled.

Melamine was also the culprit in the China dog food scandal that occurred last year. "

Dan Ross

http://www.BetterBizIdeas.com/

Wednesday, September 17, 2008

SPX 500 ready for a downturn?? Yikes, I was right....

On August 21st I posted the following thoughts re: the SPX 500 and its future direction....

"Guys, the market is rolling over, sentiment is getting very negative...... Today is NOTHING. SPX is 1268 and the July lows were 1200....... "

Here is a chart today of the SPX 500 ...take a look at the decline since then! WOW.....This unwinding of risk & liquidity crunch has been staggering....

http://stockcharts.com/charts/gallery.html?$spx

Dan Ross

http://www.BetterBizIdeas.com

"Guys, the market is rolling over, sentiment is getting very negative...... Today is NOTHING. SPX is 1268 and the July lows were 1200....... "

Here is a chart today of the SPX 500 ...take a look at the decline since then! WOW.....This unwinding of risk & liquidity crunch has been staggering....

http://stockcharts.com/charts/gallery.html?$spx

Dan Ross

http://www.BetterBizIdeas.com

ABAT & Stock Price movement

From a post I made on a stock message board a few days back...

"The stock is CLEARLY going to $3. I agree with those levels and stated that, if $3.65-$3.75 was broken that $3.00 was the likely next point "

Well, 3 days have past now and ABAT is quickly approaching $3.00. At $3.00 I'll be buying some ABAT shares for sure.

Dan Ross

Blog on China from Reuters

Interesting blog worth bookmarking....

http://blogs.reuters.com/summits/category/china-century-07/

Dan Ross

http://www.BetterBizIdeas.com/

http://blogs.reuters.com/summits/category/china-century-07/

Dan Ross

http://www.BetterBizIdeas.com/

Lithium Ion Batteries (ABAT) and Hybrid Automobiles...

Lithium Ion Batteries far out from deployment in cars

http://www.reuters.com/article/technolog... <--not with oil at $100! and http://seekingalpha.com/article/95552-en <--disagrees re: lithium ion and their mass deployment in cars anytime soon but has a biased opinion based on stock interests (my 2 cents). and LG Chemical states that Lithium Ion batteries will rule the hybrid world for the next 15-20 years http://news.yahoo.com/s/nm/20080917/tc_n...

Hopefully everyone can form their own opinions. My 2 cents is that LI-ION WILL become the standard, they will make improvements in the technology and that A123 Power Systems (a filed IPO for later this fall) will likely lead to an increase in ABAT's stock price.

Dan Ross

http://www.BetterBizIdeas.com

http://www.reuters.com/article/technolog... <--not with oil at $100! and http://seekingalpha.com/article/95552-en <--disagrees re: lithium ion and their mass deployment in cars anytime soon but has a biased opinion based on stock interests (my 2 cents). and LG Chemical states that Lithium Ion batteries will rule the hybrid world for the next 15-20 years http://news.yahoo.com/s/nm/20080917/tc_n...

Hopefully everyone can form their own opinions. My 2 cents is that LI-ION WILL become the standard, they will make improvements in the technology and that A123 Power Systems (a filed IPO for later this fall) will likely lead to an increase in ABAT's stock price.

Dan Ross

http://www.BetterBizIdeas.com

Saturday, September 13, 2008

Coolest NFL TV maps EVER!

http://the506.com/nflmaps/

The NFL is the game of U.S. despite what baseball enthusiasts would say. It is our export to the world & the most watched sport in the U.S. (per game, not total people watched since baseball has a ZILLION games).

For those that want to know what games will be broadcast in your area in a given week I present to you the coolest maps known to man :) Enjoy!

Dan Ross

http://www.BetterBizIdeas.com/

The NFL is the game of U.S. despite what baseball enthusiasts would say. It is our export to the world & the most watched sport in the U.S. (per game, not total people watched since baseball has a ZILLION games).

For those that want to know what games will be broadcast in your area in a given week I present to you the coolest maps known to man :) Enjoy!

Dan Ross

http://www.BetterBizIdeas.com/

Labels:

506.com,

Dan Ross,

Football,

http://www.BetterBizIdeas.com,

NFL

Vegas needs a new airport terminal ???

I've been hounding for awhile that Vegas traffic was really going to get hit during this economic downturn. Rooms are more expensive than ever, restaurants aren't cheap and it seems like it takes a miracle to find a blackjack table under $10 on the strip at times.

Anyway, from http://www.thestreet.com/

http://www.thestreet.com/story/10436739/1/airlines-hotels-clash-over-vegas-airport.html?puc=_htmlbooyah

"Las Vegas, a city built for visitors, is ground zero in the airline industry's effort to cut back on marginally profitable flights. But the city's powerful hoteliers are none too happy about the cutbacks. They still want the carriers to finance a new airport terminal, which is needed to support 32,000 additional hotel rooms slated to open by 2012. The timing is unfortunate. Traffic at McCarran International Airport fell 8.6% in July, compared with the same month a year earlier. In fact, traffic has fallen every month this year, except for February, which had the benefit of leap day in 2008. And the airlines aren't finished cutting. "

Oddly enough, I was talking last night with my mother re: her pending trip and she had indicated that Southwest Airlines was cutting one flight (out of two daily) that fly direct to Vegas from where she lives....

Dan Ross

http://www.BetterBizIdeas.com

Anyway, from http://www.thestreet.com/

http://www.thestreet.com/story/10436739/1/airlines-hotels-clash-over-vegas-airport.html?puc=_htmlbooyah

"Las Vegas, a city built for visitors, is ground zero in the airline industry's effort to cut back on marginally profitable flights. But the city's powerful hoteliers are none too happy about the cutbacks. They still want the carriers to finance a new airport terminal, which is needed to support 32,000 additional hotel rooms slated to open by 2012. The timing is unfortunate. Traffic at McCarran International Airport fell 8.6% in July, compared with the same month a year earlier. In fact, traffic has fallen every month this year, except for February, which had the benefit of leap day in 2008. And the airlines aren't finished cutting. "

Oddly enough, I was talking last night with my mother re: her pending trip and she had indicated that Southwest Airlines was cutting one flight (out of two daily) that fly direct to Vegas from where she lives....

Dan Ross

http://www.BetterBizIdeas.com

Sham Solar Company ?? From Forbes.com....

http://www.forbes.com/business/forbes/2008/0901/030.html

No Solar Energy Needed Here

Since Jan. 1 split-adjusted shares of what is now Prime Sun Power (otcbb: PSPW - news - people ) have risen 6,000% to a recent $4.50, for a $183 million market cap. Highlights of its latest financial statement: no cash, no operations, no employees, accounting errors, a negative net worth and a going-concern warning. Prime Sun began life in 2002 as atm Financial Corp., chartered in Nevada but hoping to service cash-dispensing outlets in Canada. That went absolutely nowhere. Majority control was acquired earlier this year by Switzerland's Rudana Investment Group, which moved the company to a Wall Street address, changed the name and said it planned "a new business model, involving solar power and other alternative energies." So far, no additional details--and no comment forthcoming from boss Gerald Sullivan. --W.P.B.

Dan Ross

http://www.BetterBizIdeas.com

No Solar Energy Needed Here

Since Jan. 1 split-adjusted shares of what is now Prime Sun Power (otcbb: PSPW - news - people ) have risen 6,000% to a recent $4.50, for a $183 million market cap. Highlights of its latest financial statement: no cash, no operations, no employees, accounting errors, a negative net worth and a going-concern warning. Prime Sun began life in 2002 as atm Financial Corp., chartered in Nevada but hoping to service cash-dispensing outlets in Canada. That went absolutely nowhere. Majority control was acquired earlier this year by Switzerland's Rudana Investment Group, which moved the company to a Wall Street address, changed the name and said it planned "a new business model, involving solar power and other alternative energies." So far, no additional details--and no comment forthcoming from boss Gerald Sullivan. --W.P.B.

Dan Ross

http://www.BetterBizIdeas.com

Friday, September 12, 2008

40/40 Club at Palazzo fails....tough times for economy & Jay-Z!

• September 8, 2008 Palazzo Wastes No Time Conversion of the 40/40 Club into a Palazzo race-and-sports book took place in what could be record time. The club, which closed last Monday, reopened on Thursday as Sportbook Bar & Grill, just in time for the kickoff of NFL season. The former nightclub has been augmented with five betting windows.

Dan Ross

http://www.BetterBizIdeas.com/

Dan Ross

http://www.BetterBizIdeas.com/

Vegas going into the Toilet - Another disturbing datapoint

I just got back from Vegas earlier this week and I thought business was off a bit. The tables didn't seem as full, restaurants, pool areas, etc.

Then I find the below info. earlier today:

http://www.lasvegasadvisor.com/whatsnews.cfm#3471

* September 11, 2008 Vegas Visitation Down in July Not since the start of the Iraq War, over five years ago, have visitation levels to Vegas fallen as low as they did in July, according to numbers released yesterday by the Las Vegas Convention & Visitors Authority. Room rates were off 10% from July '07, while visitation was down 5%, as hotel occupancy, hovering around 88%. More conventions were held, but conventioneers curtailed their stays.

* September 10, 2008 NV Down -13% in July Comparison to a very robust July 2007 gives this year's July casino-revenue numbers a difficult act to follow, resulting in declines that are way above average for the year to date. Measured against last year, the state was -13% overall, with Strip slot revenues, table win and baccarat win -8%, 21% and -26%, respectively. Most Clark County jurisdictions experienced very adverse comparisons, with the Boulder Strip and North Las Vegas having the worst of it. By contrast, Reno was only off 1% and the unpredictable South Tahoe area noted an 11% increase. July's numbers mark seven straight months of decline for Nevada casinos. As far as trends go, table and baccarat drop swing back and forth, but slot handle on the Strip is further and further off last year's pace.

Dan Ross

http://www.BetterBizIdeas.com

Then I find the below info. earlier today:

http://www.lasvegasadvisor.com/whatsnews.cfm#3471

* September 11, 2008 Vegas Visitation Down in July Not since the start of the Iraq War, over five years ago, have visitation levels to Vegas fallen as low as they did in July, according to numbers released yesterday by the Las Vegas Convention & Visitors Authority. Room rates were off 10% from July '07, while visitation was down 5%, as hotel occupancy, hovering around 88%. More conventions were held, but conventioneers curtailed their stays.

* September 10, 2008 NV Down -13% in July Comparison to a very robust July 2007 gives this year's July casino-revenue numbers a difficult act to follow, resulting in declines that are way above average for the year to date. Measured against last year, the state was -13% overall, with Strip slot revenues, table win and baccarat win -8%, 21% and -26%, respectively. Most Clark County jurisdictions experienced very adverse comparisons, with the Boulder Strip and North Las Vegas having the worst of it. By contrast, Reno was only off 1% and the unpredictable South Tahoe area noted an 11% increase. July's numbers mark seven straight months of decline for Nevada casinos. As far as trends go, table and baccarat drop swing back and forth, but slot handle on the Strip is further and further off last year's pace.

Dan Ross

http://www.BetterBizIdeas.com

Tuesday, September 9, 2008

WAMU CEO out.....HUGE win for regional banks...

So I have been out on vacation the last few days and my phone has been getting lit up with txt messages from friends/buddies re: Fannie Mae/ Freddie Mac, WAMU, etc and they are curious re: my thoughts about it. To be honest, I was COMPLETELY out of the loop on this as I was enjoying my time off.

I read this commentary re: WAMU and its CEO getting axed yesterday and it really rang a bell with something that Jim Cramer talked about re: how the FDIC's new strategy is going to be a HUGE win for regional banks.

Here is something to chew on. From something I read.....not Cramer....

"Kerry Killinger was one of those lucky guys in the right place at the right time. He built WAMU by buying distressed thrifts out of the last S&L crisis. It was a lucky streak of acquisitions. Essentially he had acquired a bunch of rain buckets which collected the mortgage refi bounty resulting from the lowest bond yields in history. He never effectively integrated those acquisitions. When the drunken refi mortgage party ended, he couldn't pull himself away from the tap and charged headlong into subprime to keep the party going. It was a disaster in the making."

Now hear Cramer's take on the FDIC and their changing strategy re: banks.

http://www.thestreet.com/story/10435631/1/cramers-mad-money-recap-fdic-to-the-rescue.html

While in Vegas the end of last week and early this week I noticed that Zion's bank (one of their subsidiaries) had taken over a large Henderson NV bank via the same method in the link above. So we now have TWO examples of regional banks buying deposits cheaply and getting bigger. We just have to hope that these folks HIRE or already have people that can integrate all these systems/banks together.

For the record, Cramer likes BB&T, a bank that he considers a conservative regional lender with a sound balance sheet that should be allowed to buy these guys on the cheap throughout FL and the SE.

Dan Ross

http://www.BetterBizIdeas.com

I read this commentary re: WAMU and its CEO getting axed yesterday and it really rang a bell with something that Jim Cramer talked about re: how the FDIC's new strategy is going to be a HUGE win for regional banks.

Here is something to chew on. From something I read.....not Cramer....

"Kerry Killinger was one of those lucky guys in the right place at the right time. He built WAMU by buying distressed thrifts out of the last S&L crisis. It was a lucky streak of acquisitions. Essentially he had acquired a bunch of rain buckets which collected the mortgage refi bounty resulting from the lowest bond yields in history. He never effectively integrated those acquisitions. When the drunken refi mortgage party ended, he couldn't pull himself away from the tap and charged headlong into subprime to keep the party going. It was a disaster in the making."

Now hear Cramer's take on the FDIC and their changing strategy re: banks.

http://www.thestreet.com/story/10435631/1/cramers-mad-money-recap-fdic-to-the-rescue.html

While in Vegas the end of last week and early this week I noticed that Zion's bank (one of their subsidiaries) had taken over a large Henderson NV bank via the same method in the link above. So we now have TWO examples of regional banks buying deposits cheaply and getting bigger. We just have to hope that these folks HIRE or already have people that can integrate all these systems/banks together.

For the record, Cramer likes BB&T, a bank that he considers a conservative regional lender with a sound balance sheet that should be allowed to buy these guys on the cheap throughout FL and the SE.

Dan Ross

http://www.BetterBizIdeas.com

Friday, September 5, 2008

Bad Business / Best Business

The next few links have NOTHING to do with business and EVERYTHING to do with business.

1) I present a link to the home of Tiger Woods Maui Vacation Home. This guy will be the first BILLIONAIRE athlete, in my opinion. His endorsement deals are ENORMOUS

http://www.snopes.com/photos/architecture/tigerwoods.asp

2) I then present indoor skiing in DUBAI, you know that country in the desert.......Just shows how you can do anything if you have enough black gold in the ground and don't really care how you invest those $$$. DUBAI will be a tale of great investments or HORRIBLE decision making in the next 30 years. We'll have to see how the place holds up as they run out of oil and try to make the country a tourism location and business hub for the Middle East.

http://www.snopes.com/photos/architecture/indoorski.asp#photo5

3) World's largest pool in Chile. I am fascinated by this because in Chile you have a nation that has a booming economy and rapidly developing middle class. The economy is based on commodities such as oil, they have a fast growing wine export industry and have become a bit of a location in tourism of late. People go there for skiing during the Northern Hemisphere's summer and the resort below is nothing short of STAGGERING.

http://www.snopes.com/photos/architecture/largestpool.asp

Dan Ross

http://www.BetterBizIdeas.com/

1) I present a link to the home of Tiger Woods Maui Vacation Home. This guy will be the first BILLIONAIRE athlete, in my opinion. His endorsement deals are ENORMOUS

http://www.snopes.com/photos/architecture/tigerwoods.asp

2) I then present indoor skiing in DUBAI, you know that country in the desert.......Just shows how you can do anything if you have enough black gold in the ground and don't really care how you invest those $$$. DUBAI will be a tale of great investments or HORRIBLE decision making in the next 30 years. We'll have to see how the place holds up as they run out of oil and try to make the country a tourism location and business hub for the Middle East.

http://www.snopes.com/photos/architecture/indoorski.asp#photo5

3) World's largest pool in Chile. I am fascinated by this because in Chile you have a nation that has a booming economy and rapidly developing middle class. The economy is based on commodities such as oil, they have a fast growing wine export industry and have become a bit of a location in tourism of late. People go there for skiing during the Northern Hemisphere's summer and the resort below is nothing short of STAGGERING.

http://www.snopes.com/photos/architecture/largestpool.asp

Dan Ross

http://www.BetterBizIdeas.com/

Labels:

Dan Ross,

http://www.BetterBizIdeas.com,

Vacation

Thursday, September 4, 2008

Gambling Stocks / Harrah's Entertainment Hotel/Casino Availability Calendar -Las Vegas

I somehow stumbled across this calendar while trying to find things to do in Vegas & change my room for one night on a planned trip out to Vegas.

I thought it might interest people to see how Harrah's prioritizes/prices their casinos. Caesars ifs their flagship property and Imperial Palace is for the more economically minded folks.

Harrah's Entertainment Hotel/Casino Availability Calendar -Las Vegas

So, when I look at Vegas you have WYNN, LVS & MGM as the publicly traded "flagship" casinos. WYNN/LVS are Vegas/Macau Plays (they have a higher % of revenue derived/potential derived) from over in Macau If I wanted a pure play investment on Macau I would buy MPEL (Melco Casinos). If I wanted the next best investment for Macau I would by LVS since I hear the Venetian is phenomenal/just as good over there. Additionally, you get a hedge with the Venetian here in the U.S. I've heard that MGM/Wynn kind of skimped on their stuff over there vs. Vegas.

Now, if I had to invest in Vegas HANDS DOWN I would buy MGM since they own 80% of the best casinos in that city. You would get a tad exposure to Macau but realistically it is a Vegas play plain and SIMPLE.

Why am I babbling about Macau?

http://www.bloggingstocks.com/tag/gambling+stocks/

"Today, Macau has become the Las Vegas of China. It is the only city in the region with fully legalized gambling. And gambling is deeply engrained in the Asian culture. Plus, Macau is within a five-hour flight of three billion people - nearly half the world's population. 80% of their revenue is derived from whales (concern there). The majority (55%) came from mainland China, but many more visited from Hong Kong (30%) and Taiwan (9%). These tourists are flocking to Macau not because of its history or picturesque seaside location. They're coming to gamble.

Non Macau Thoughts

Harrahs used to be an investment that was based on proliferation of gaming throughout the U.S. since their Horseshoe/Harrahs branded casinos were expanding throughout the U.S. Since they were taken private last year in a HUGE private equity takeover I won't talk about them anymore.

There are other gaming stocks/investments but they have different themes.

Here are some of them

Isle of Capri (ISLE) <-growth of gaming throughout the U.S. I personally find their casinos to be too dumpy for me. Tropicana Entertainment filed for Chapter 11 in May 2008, defaulting on $2.67 billion in bank and bond debt.

IGT (International Gaming Technology) - IGT is the world's leading slot machine manufacturer. In addition to basic slot machine design and sales, the company generates more than half of its revenues by leasing machines to casinos in exchange for a percentage of the net win. In a recent poll conducted by Casino Player magazine, seven of the top ten most popular video slots were introduced by IGT.

Dan Ross

http://www.BetterBizIdeas.com

I thought it might interest people to see how Harrah's prioritizes/prices their casinos. Caesars ifs their flagship property and Imperial Palace is for the more economically minded folks.

Harrah's Entertainment Hotel/Casino Availability Calendar -Las Vegas

So, when I look at Vegas you have WYNN, LVS & MGM as the publicly traded "flagship" casinos. WYNN/LVS are Vegas/Macau Plays (they have a higher % of revenue derived/potential derived) from over in Macau If I wanted a pure play investment on Macau I would buy MPEL (Melco Casinos). If I wanted the next best investment for Macau I would by LVS since I hear the Venetian is phenomenal/just as good over there. Additionally, you get a hedge with the Venetian here in the U.S. I've heard that MGM/Wynn kind of skimped on their stuff over there vs. Vegas.

Now, if I had to invest in Vegas HANDS DOWN I would buy MGM since they own 80% of the best casinos in that city. You would get a tad exposure to Macau but realistically it is a Vegas play plain and SIMPLE.

Why am I babbling about Macau?

http://www.bloggingstocks.com/tag/gambling+stocks/

"Today, Macau has become the Las Vegas of China. It is the only city in the region with fully legalized gambling. And gambling is deeply engrained in the Asian culture. Plus, Macau is within a five-hour flight of three billion people - nearly half the world's population. 80% of their revenue is derived from whales (concern there). The majority (55%) came from mainland China, but many more visited from Hong Kong (30%) and Taiwan (9%). These tourists are flocking to Macau not because of its history or picturesque seaside location. They're coming to gamble.

Non Macau Thoughts

Harrahs used to be an investment that was based on proliferation of gaming throughout the U.S. since their Horseshoe/Harrahs branded casinos were expanding throughout the U.S. Since they were taken private last year in a HUGE private equity takeover I won't talk about them anymore.

There are other gaming stocks/investments but they have different themes.

Here are some of them

Isle of Capri (ISLE) <-growth of gaming throughout the U.S. I personally find their casinos to be too dumpy for me. Tropicana Entertainment filed for Chapter 11 in May 2008, defaulting on $2.67 billion in bank and bond debt.

IGT (International Gaming Technology) - IGT is the world's leading slot machine manufacturer. In addition to basic slot machine design and sales, the company generates more than half of its revenues by leasing machines to casinos in exchange for a percentage of the net win. In a recent poll conducted by Casino Player magazine, seven of the top ten most popular video slots were introduced by IGT.

Dan Ross

http://www.BetterBizIdeas.com

Wednesday, September 3, 2008

Nasdaq-listed Zhongpin Inc (HOGS.NASDAQ) Link

http://thechinaperspective.com/articles/livingonthepig039sback4419/index.html

A few key takeaways....

"New pork processing industry regulations take effect at the start of August. How will these affect your company? We view this as a positive for Zhongpin as the new regulations will definitely speed up the modernization of the pork processing industry in China and encourage the transition from the traditional wet market to modern “dry” market processing. We expect that some processors who cannot meet the national standard will eventually leave the industry and consumers will have better access to safer and healthier pork products. As a leading meat and food processing company that utilizes state-of-the-art equipment and advanced technology in our production, we believe the new regulation will enable us to seize opportunities for further expansion and increase our market share, especially in second and third-tier cities"

"When do you expect to complete your new factories, and how will this increase your total production capacity? The new factory in Luoyang City had already started production at the end of June and the Shangqiu plant will begin operations by the end of the fourth quarter of 2008. These two plants will increase our capacity of chilled and frozen pork to 471,560 metric tons, excluding outsourcing from OEMs, equivalent to a 42% year-over-year growth rate. In September 2008, a new facility in Changge City with 28,800 metric tons of prepared meat will start production, which indicates our capacity will increase 114% to 54,000 metric tons per year after completion. Our annual production capacity of fruit and vegetables will increase by 114% to 56,280 metric tons when a facility in Changge comes on-line by the end of this year."

Dan Ross

http://www.BetterBizIdeas.com/

A few key takeaways....

"New pork processing industry regulations take effect at the start of August. How will these affect your company? We view this as a positive for Zhongpin as the new regulations will definitely speed up the modernization of the pork processing industry in China and encourage the transition from the traditional wet market to modern “dry” market processing. We expect that some processors who cannot meet the national standard will eventually leave the industry and consumers will have better access to safer and healthier pork products. As a leading meat and food processing company that utilizes state-of-the-art equipment and advanced technology in our production, we believe the new regulation will enable us to seize opportunities for further expansion and increase our market share, especially in second and third-tier cities"

"When do you expect to complete your new factories, and how will this increase your total production capacity? The new factory in Luoyang City had already started production at the end of June and the Shangqiu plant will begin operations by the end of the fourth quarter of 2008. These two plants will increase our capacity of chilled and frozen pork to 471,560 metric tons, excluding outsourcing from OEMs, equivalent to a 42% year-over-year growth rate. In September 2008, a new facility in Changge City with 28,800 metric tons of prepared meat will start production, which indicates our capacity will increase 114% to 54,000 metric tons per year after completion. Our annual production capacity of fruit and vegetables will increase by 114% to 56,280 metric tons when a facility in Changge comes on-line by the end of this year."

Dan Ross

http://www.BetterBizIdeas.com/

Tuesday, September 2, 2008

$2 billion Ospraie Fund to Close...

http://www.reuters.com/article/businessNews/idUSN0245078920080903?feedType=RSS&feedName=businessNews&rpc=408&sp=true

NEW YORK (Reuters) - Hedge fund manager Ospraie Management LLC will close its flagship fund after it plunged 27 percent in August on losses in energy, mining and natural resources equity holdings, in one Stock Market opened up 200 points today but was down by the end of the day.

One reason....every commodity was getting HAMMERED as the U.S. dollar appreciated. Apparently the U.S. $$$ strength has taken its toll on one VERY large Hedge Fund in the last month, which had to sell some positions throughout the day. They announced they were closing the $2 billion hedge fund late in the day Tuesday.

Dan Ross

http://www.BetterBizIdeas.com

NEW YORK (Reuters) - Hedge fund manager Ospraie Management LLC will close its flagship fund after it plunged 27 percent in August on losses in energy, mining and natural resources equity holdings, in one Stock Market opened up 200 points today but was down by the end of the day.

One reason....every commodity was getting HAMMERED as the U.S. dollar appreciated. Apparently the U.S. $$$ strength has taken its toll on one VERY large Hedge Fund in the last month, which had to sell some positions throughout the day. They announced they were closing the $2 billion hedge fund late in the day Tuesday.

Dan Ross

http://www.BetterBizIdeas.com

Mike Tyson Ohio Home

Interesting website. Just a sign of how one can go from complete extravagance/riches to poverty. I'll be more frugal than Iron Mike!

http://illicitohio.illicitohio.com/tyson6.htm

Dan Ross

http://www.BetterBizIdeas.com

http://illicitohio.illicitohio.com/tyson6.htm

Dan Ross

http://www.BetterBizIdeas.com

Labels:

Dan Ross,

http://www.BetterBizIdeas.com,

Investing

Monday, September 1, 2008

BRIC growth slowing notably?

Brazil, Russia, India and China are called the BRIC countries. These are former "3rd world" economies that are experiencing rapid economic growth, have large populations and have generated some of the largest investor returns in the world for the last 5-10 years.

With occupancy rates in some Indian hotels approaching 60% (at 90% last year) the growth in the hospitality industry is quickly slowing down.

From Business Standard

http://www.business-standard.com/india/storypage.php?autono=332964

"The total number of hotel rooms planned is being cut by 40 per cent and many developers are putting their portfolio on sale due to the decreasing business traffic, rise in interest rates and economic slowdown. Nearly 50,000 hotel rooms were planned in the country and that number may not be built by developers as business traffic has fallen 30 per cent in the last couple of months and lending rates for developers have increased significantly"

Dan Ross

http://www.BetterBizIdeas.com/

With occupancy rates in some Indian hotels approaching 60% (at 90% last year) the growth in the hospitality industry is quickly slowing down.

From Business Standard

http://www.business-standard.com/india/storypage.php?autono=332964

"The total number of hotel rooms planned is being cut by 40 per cent and many developers are putting their portfolio on sale due to the decreasing business traffic, rise in interest rates and economic slowdown. Nearly 50,000 hotel rooms were planned in the country and that number may not be built by developers as business traffic has fallen 30 per cent in the last couple of months and lending rates for developers have increased significantly"

Dan Ross

http://www.BetterBizIdeas.com/

Subscribe to:

Posts (Atom)