Below is a link to their investor presentation from April 2008

http://www.bridge-line.com/images/corporate-presentation-icon.jpg

Here is what I like about the company's prospects:

1) Acquiring companies at reasonable multiples. This tends to generate better cash flow growth and, via acquisitions, enables the company to grow at faster than market/industry norms. They have a dedicated team looking for opportunities.

2) Internal growth within each market (city) they operate in. They want to add accounts within each city + selectively move into new cities when accretive deals present themselves.

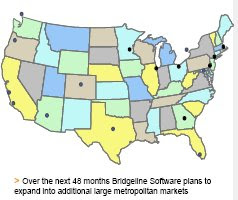

3) Substantial growth for further market penetration via new cities/team acquisition.

4) This is a company that has executed well and isn't a short-term growth play / trade. This is a multi-year hold, in my opinion. That is why my investment strategy for such a company is to buy an initial position and then build up a much bigger position over the course of 6-12 months (dollar cost averaging) as I see the company executing its strategy and as I see them post their results over the forthcoming quarters.

Here are a few pictures/numbers worth noting

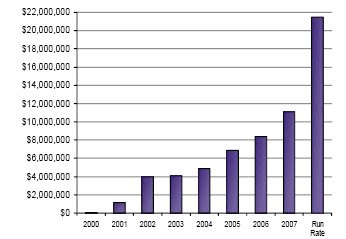

Here is a chart showing their revenue growth over the last 7 years. Pretty impressive, huh?

http://caps.fool.com/Ticker/BLSW.aspx <--click on growth rates for 3 year view through 2007.

Here is their 2008 1Q EPS announcement, which shows accelerating growth.

http://biz.yahoo.com/pz/080501/141542.html

Risks

This is a very thinly traded stock and subject to BIG swings. Trendlines have to be looked at closely relative to the VOLUME of the direction in which the stock is moving as the stock can trade up or down on VERY small volume. Big volume moves (accumulation/distribution) need to be looked at closer as better gauges of investor's long-term thoughts on the company's prospects.

I think the assessment of Cognizant ( a competitor of Bridgeline's) in the attached article is SPOT on... http://www.fool.com/investing/value/2008/05/20/the-growth-stocks-you-should-buy.aspx

Bridgeline is an information technology consultant and outsourcer, a business particularly subject to the vagaries of the economy. When the economy slows consultants can be an easy way for businesses to reduce their expenses. What's more, there are few barriers against competition, since it isn't difficult to start a consulting company. Even worse, it's a hard business to grow because productivity in consulting companies is directly related to the number of employees. If you want to double your sales, you typically have to double your workforce.

My bottom line:

BLSW trades at nearly 1x its current annual sales rate (most recent quarter * 4). If the company continues to grow via acquisition (new cities) + add additional customers in existing markets, which they seem quite capable of doing, the stock has additional revenue/profit upside. Cognizant, a market peer (albeit much bigger) trades at 3.5x sales whereas BLSW, a TINY, underfollowed company, trades at 1x sales. Once the company gets to $50 million or $100 million the company will be more widely followed and will attract a larger market multiple. Having said this, I think that might take awhile....But, with such a huge upside, and with them being takeover bait (due to low market multiple) I really think the downside is pretty minimal for this company. This could end up being a 10 bagger over the next 3-5 years if the company can profitably grow to $100 million via their current strategy and execute it as well as they have over the last few years.

Dan Ross

http://www.betterbizbooks.com/